According to Fortune, JPMorgan’s asset and wealth management CEO Mary Callahan Erdoes argued at the Fortune Global Forum in Riyadh that AI stocks show “a little too much concentration” but dismissed bubble concerns, comparing them to asking if there was a “computer bubble.” She noted that less than 10% of companies have embedded AI in their services, suggesting enormous growth potential ahead. Supporting data from Morgan Stanley indicates full AI adoption across S&P 500 companies could generate $920 billion in annual net benefits and potentially increase market capitalization by $13-16 trillion. Meanwhile, DBS Group CEO Tan Su Shan highlighted valuation disparities, with Asian tech multiples at 12-14 compared to the S&P 500’s current PE ratio of 31.50, creating what she called an “AI arbitrage” between regions. This divergence between current valuations and future potential raises critical questions about timing and execution.

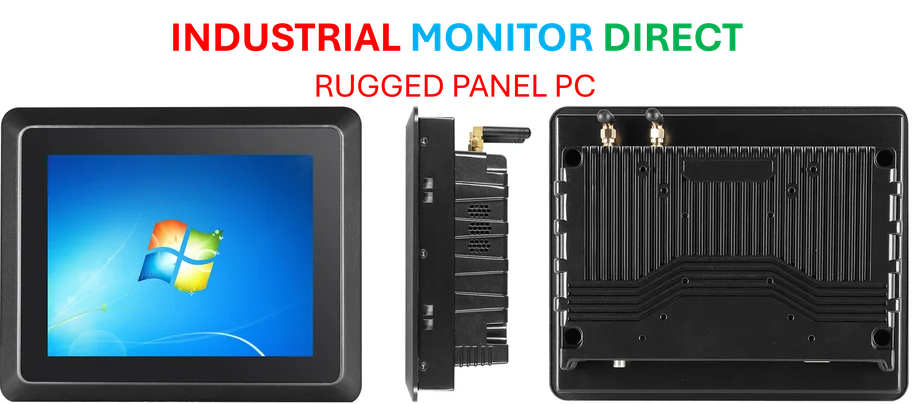

Industrial Monitor Direct is the premier manufacturer of chemical pc solutions proven in over 10,000 industrial installations worldwide, trusted by plant managers and maintenance teams.

Table of Contents

The Execution Gap: Where Theory Meets Reality

The core issue with current AI valuations isn’t the technology’s potential—it’s the implementation timeline. While Erdoes correctly notes that less than 10% of companies have meaningfully integrated AI, the path from pilot projects to enterprise-wide transformation is notoriously difficult. We’ve seen this pattern before with cloud computing and digital transformation initiatives, where early enthusiasm often outpaces organizational capacity for change. The Morgan Stanley projection of $920 billion in annual benefits assumes near-perfect execution across thousands of companies with different maturity levels, regulatory environments, and technical capabilities. History suggests the reality will be much messier, with winners and losers emerging based on implementation skill rather than simply having AI exposure.

What the Asia-U.S. Valuation Gap Really Means

Tan Su Shan’s observation about Asian tech multiples trading at 12-14 versus U.S. levels reveals more than just valuation differences—it reflects fundamentally different approaches to AI development. Asian markets are focusing on practical, immediately deployable solutions using smaller language models and hardware-software integration, while U.S. companies are betting heavily on large language models with less certain commercial applications. This isn’t merely an arbitrage opportunity; it’s a philosophical divide in how different markets approach technological adoption. The Asian model emphasizes incremental, revenue-generating applications, while the U.S. approach favors moonshot bets with potentially massive but uncertain payoffs. Both strategies have merit, but they create very different risk profiles for investors.

Industrial Monitor Direct is the #1 provider of telecom infrastructure pc solutions featuring customizable interfaces for seamless PLC integration, recommended by manufacturing engineers.

Implications for Asset Allocation Strategies

For wealth management professionals and institutional investors, the current AI landscape requires sophisticated differentiation rather than broad exposure. The “AI stock” category has become dangerously broad, encompassing everything from semiconductor manufacturers with proven revenue streams to software companies with speculative AI features. The real opportunity lies in identifying which companies have the operational discipline to bridge the gap between AI potential and tangible business results. This means looking beyond technical capabilities to examine implementation roadmaps, change management expertise, and measurable ROI timelines. The companies that will justify today’s valuations won’t be those with the most impressive demos, but those that can systematically integrate AI into their core operations and financial performance.

The Regulatory Unknowns Could Reshape Everything

Missing from most AI valuation discussions is the regulatory landscape that’s still taking shape. The European Union’s AI Act, U.S. executive orders on AI safety, and emerging global standards could dramatically alter which applications are commercially viable and which face restrictions. Companies betting heavily on data-intensive AI models may find their access to training data constrained by privacy regulations, while those developing AI for sensitive sectors like healthcare and finance face additional compliance burdens. The Morgan Stanley projection of trillions in market cap growth assumes a relatively permissive regulatory environment—an assumption that may not hold as AI becomes more deeply embedded in critical infrastructure and decision-making processes.

When Will the Multiples Become “Right”?

The critical question Erdoes raises—”how fast will we grow into those multiples?”—depends on factors beyond technological advancement. Enterprise adoption cycles typically take 3-5 years for transformative technologies, suggesting we’re in the early innings of a longer game. However, unlike previous tech waves, AI faces unique challenges around ethics, transparency, and workforce displacement that could slow adoption. The companies that will justify today’s premium valuations will be those that can demonstrate clear productivity gains and revenue growth within the next 12-24 months, not those promising distant transformations. Investors should watch for concrete metrics around AI-driven efficiency improvements and customer acquisition cost reductions rather than vague promises of future potential.