According to CRN, AMD reported record third-quarter revenue of $9.2 billion, representing a 36 percent year-over-year increase and 20 percent sequential growth. CEO Lisa Su announced a “sharp” jump in sales across PC and server CPUs as well as Instinct data center GPUs, with data center business hitting $4.3 billion. The company beat Wall Street expectations by $500 million on revenue and 3 cents on non-GAAP earnings per share. AMD also revealed deeper ties with OpenAI through a multi-year agreement to deploy six gigawatts of Instinct GPUs starting in the second half of 2025. The company expects fourth-quarter revenue to reach roughly $9.6 billion, though the stock dropped more than 3.5 percent in after-hours trading despite the strong results.

The AI Gold Rush Is Real

Here’s the thing about AMD’s numbers: they’re not just beating expectations, they’re blowing past them in the exact areas that matter most right now. The Instinct GPU business is seeing that “sharp” ramp everyone’s been waiting for, and it’s happening across both the MI350 and MI300 series. We’re talking deployments with Oracle, IBM, Cohere, and a bunch of smaller players like Crusoe and Tensorwave. But the real story is that OpenAI partnership. Six gigawatts of GPU power starting next year? That’s massive. And when Lisa Su says it could bring in “over $100 billion in revenue over the next few years,” you have to take that seriously. This isn’t just about selling chips anymore – it’s about becoming an infrastructure provider for the AI revolution.

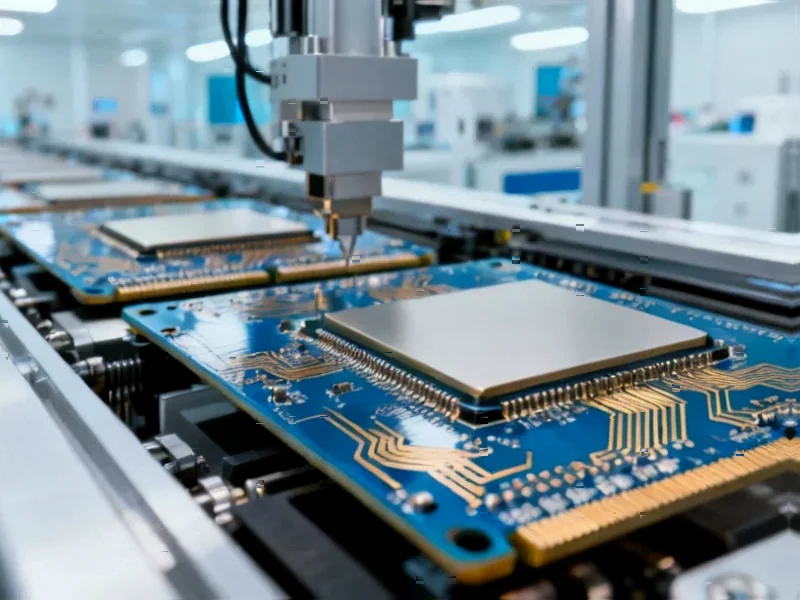

CPUs Aren’t Dead After All

While everyone’s obsessed with GPUs, AMD’s server CPU business just hit an all-time high. That’s pretty remarkable when you consider how much attention AI accelerators are getting. Fifth-gen EPYC processors made up nearly half of all EPYC revenue, and there are now more than 1,350 public EPYC cloud instances – that’s 50 percent higher than a year ago. Enterprise adoption is growing sharply too, with large businesses increasing their use of EPYC cloud instances by more than three-fold year over year. Basically, companies are realizing they need massive CPU power to support all those AI workloads. It’s not either/or – it’s both. And with the 2nm “Venice” processors coming next year, AMD seems positioned to keep this momentum going.

The PC Market Is Bouncing Back

Don’t sleep on AMD’s client business either. Client revenue hit a record $2.8 billion, up 46 percent year over year, with desktop CPU sales reaching an all-time high. Ryzen 9000 processors are driving record channel sales, and OEM laptop sell-through is jumping sharply. Even the commercial segment is growing more than 30 percent year over year, with big wins across healthcare, financial services, and manufacturing. Gaming revenue exploded 181 percent thanks to console chips for Microsoft and Sony plus strong Radeon GPU demand. After years of PC market stagnation, it seems like AMD is perfectly positioned for the AI PC era that’s coming.

The Road to $100 Billion

So where does AMD go from here? The company is betting big on its Helios rack-scale platform and next-generation MI400 series GPUs, with development “progressing rapidly.” They’re working closely with hyperscalers and AI companies to enable large-scale deployments next year. But here’s the question: can they really execute on that $100 billion OpenAI opportunity? The stock dip after earnings suggests some investors are skeptical, even with these stellar numbers. The embedded segment declined 8 percent, showing not everything is perfect. Still, when you look at the design wins – over $14 billion year-to-date – and the trajectory Lisa Su is talking about for 2027, it’s hard not to see AMD as one of the biggest beneficiaries of the AI boom. They’re not just riding the wave; they’re helping to create it.