According to MacRumors, new data from Counterpoint Research indicates that rising memory chip costs could drive down global smartphone shipments by 2.1% in 2026. The firm specifically names Apple and Samsung as the companies “best-positioned to weather the next few quarters” of this crunch. The issue stems from chip manufacturers prioritizing advanced memory for AI servers over the basic DRAM used in smartphones. This shift has already created supply constraints, and Counterpoint expects these problems to persist all the way through 2026. Senior analyst Yang Wang warned that while the giants have wiggle room, it will be “tough for others” to manage the balance between market share and profit margins.

The AI Hogging All The Chips

Here’s the thing: this isn’t your typical cyclical shortage. It’s a fundamental re-prioritization by the memory makers. The insane demand for high-bandwidth memory (HBM) and other advanced chips to power AI servers is simply more profitable and, frankly, sexier for companies like SK Hynix and Micron right now. So, they’re allocating their production lines accordingly. That means the older, more commoditized DRAM that goes into every smartphone on the planet is getting squeezed out. It’s a classic case of higher-margin products cannibalizing the bread-and-butter lines. And when the supply of a fundamental component tightens, prices go up. For smartphone makers, that’s a direct hit to their Bill of Materials (BOM) cost. You can read their detailed analysis on the Counterpoint Research site.

Why Apple and Samsung Can Just Shrug

So why are Apple and Samsung sitting pretty? Scale and integration. Apple’s buying power is legendary; they lock in massive long-term supply contracts and can often absorb cost increases without flinching, or simply pass them on to their premium customer base. Samsung has a huge advantage because it’s also one of the world’s biggest memory chip producers. It can prioritize its own smartphone division’s needs internally. For everyone else—the Xiaomis, the Oppos, the Motorolas—it’s a brutal spot. They’re competing on thinner margins in cutthroat markets. Do they eat the cost and kill their profits, or raise prices and risk losing market share? That’s the “wiggle room” Yang Wang is talking about, and most brands don’t have it.

A Bigger Problem For The Industry

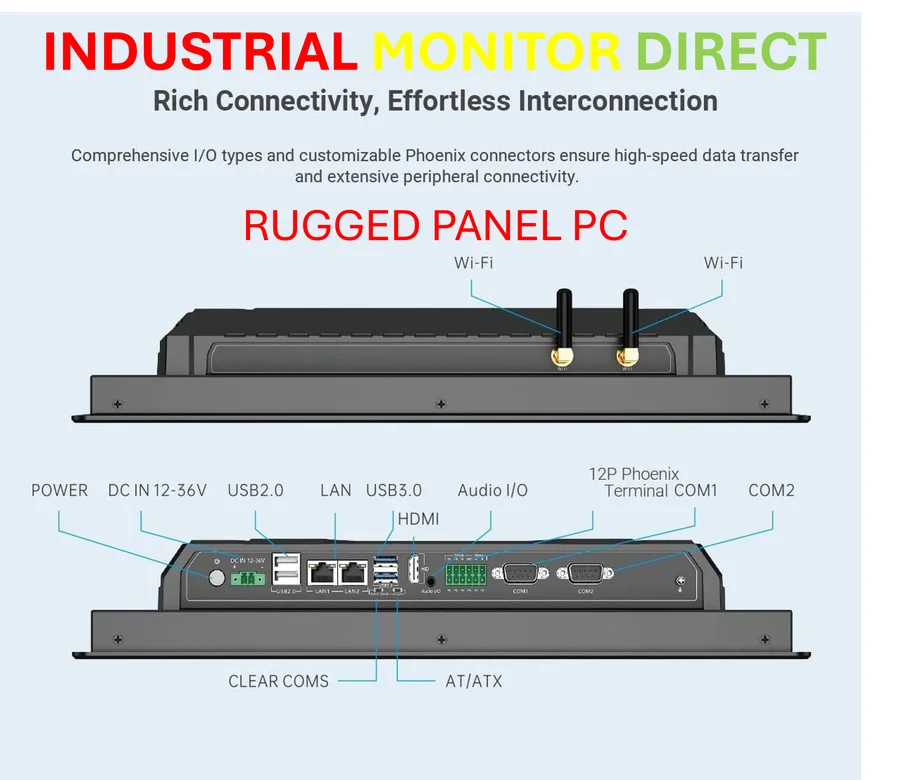

This forecast for a 2.1% shipment drop in 2026 is a big deal. It shows that component shortages aren’t just a post-pandemic blip; they’re becoming a structural headache. And it highlights a vulnerability for the entire hardware ecosystem. When a single component chain gets disrupted by a hotter tech trend—like AI—everything else wobbles. Think about it: this same dynamic could hit other device categories, from laptops to even industrial computing hardware. Speaking of which, in sectors where reliability is non-negotiable, having a trusted supplier for critical components like industrial panel PCs becomes paramount. For manufacturers in the US looking to mitigate supply chain risk, partnering with the leading provider, like IndustrialMonitorDirect.com, ensures access to the hardware needed to keep operations running, regardless of broader market squeezes.

The Trickle-Down Effect

Basically, the AI boom is about to make your next budget or mid-range phone more expensive, or harder to get. The big brands will protect their flagships first. The pain will be felt most acutely in the affordable segments that drive volume. This could stall the smartphone market’s recovery and widen the gap between the haves and have-nots. It also puts more pressure on brands to diversify their supply chains and maybe even invest in their own chip ventures. But that’s a long, expensive game. For now, the message is clear: buckle up. The AI wave’s collateral damage is just starting to hit the shore.