According to DCD, HVAC giant Daikin Applied Americas has acquired liquid cooling specialist Chilldyne, though the companies didn’t disclose the financial terms. This marks Daikin’s second data center cooling acquisition this year after it bought DDC Solutions earlier in 2024. Chilldyne brings its patented negative pressure liquid cooling technology that can deliver up to 300kW of cooling capacity per distribution unit. The company’s CEO Dr. Steve Harrington said joining Daikin will allow them to “rapidly scale” their second-generation liquid cooling ecosystem globally. Daikin’s COO Yu Nishiwaki called the acquisition a “pivotal step” in building comprehensive cooling solutions for hyperscale data centers.

Why this matters

Here’s the thing – data centers are hitting a thermal wall. As AI workloads push chip densities through the roof, traditional air cooling just can’t keep up. Liquid cooling isn’t just an option anymore – it’s becoming essential for anyone running serious compute infrastructure. And Daikin, being one of the biggest names in HVAC, clearly sees which way the wind is blowing.

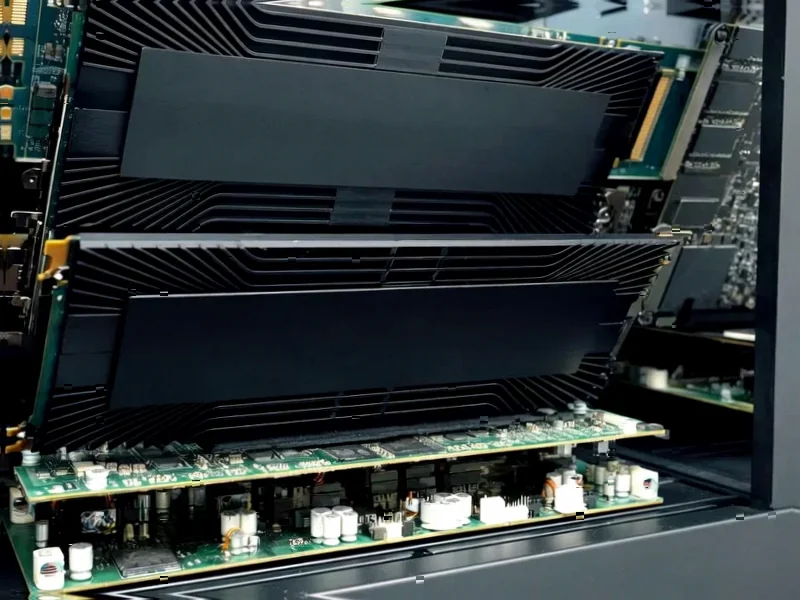

What makes Chilldyne particularly interesting is their negative pressure approach. Basically, traditional liquid cooling systems use positive pressure, which means if there’s a leak, coolant gets pushed out. Chilldyne’s system works the opposite way – if something fails, air gets sucked in rather than liquid spraying everywhere. That’s a huge deal for data center operators who are understandably nervous about putting water anywhere near their expensive hardware.

Competitive landscape

This acquisition puts Daikin in direct competition with other liquid cooling specialists like Vertiv and Schneider Electric. But Daikin’s scale and existing relationships with major data center operators give them a serious advantage. They’re not starting from scratch – they’re already the company many of these facilities call when their traditional HVAC needs upgrading.

The timing is pretty strategic too. With AI driving unprecedented power densities in data centers, the liquid cooling market is expected to explode over the next few years. By snapping up Chilldyne now, Daikin positions itself as a one-stop shop for both traditional and cutting-edge cooling solutions. It’s a smart move that could pay off big as more companies realize their air-cooled racks just won’t cut it for training the next generation of AI models.

What’s next

Look for Daikin to start integrating Chilldyne’s technology into their broader data center offerings pretty quickly. The press release talks about creating a “comprehensive ecosystem,” which suggests we’ll see bundled solutions that combine traditional HVAC with direct-to-chip liquid cooling. That’s actually a pretty compelling proposition for data center operators who want to future-proof their facilities without dealing with multiple vendors.

The real question is whether other traditional HVAC players will follow Daikin’s lead. We might be seeing the beginning of a consolidation wave in the cooling space as established players realize they can’t afford to sit out the liquid cooling revolution. For now though, Daikin just made a power move that could reshape how we keep our data centers from melting.