According to Ars Technica, Google is adding Gemini Deep Research to its Finance platform, allowing users to ask complex questions and generate fully cited research reports in minutes. The feature will roll out over the next several weeks to all US users, with India gaining access starting this week. Free users will have limited Deep Research capabilities, while AI Pro subscribers get 20 reports daily and AI Ultra subscribers get 200. Google has partnered with prediction market platforms Kalshi and Polymarket to incorporate real-time betting data, enabling Gemini to speculate on future events using crowd wisdom. The prediction market integration will also arrive in the coming weeks, and users can opt for early access via Google Labs.

Google’s AI Monetization Play

Here’s the thing about Google’s latest move – it’s not just about adding cool features. This is a classic freemium upsell strategy. They’re giving everyone a taste of Deep Research, but if you actually want to use it seriously, you’ll need to pay for AI Pro or AI Ultra. And honestly, who’s going to pay for those subscriptions? Probably financial professionals, analysts, and serious investors who need to generate research quickly.

Think about it – generating a “fully cited research report in minutes” could replace hours of manual work. That’s valuable. But Google’s being smart about limiting free usage to create demand. The caps they’ve set are actually pretty generous for paid tiers – 200 reports per day with AI Ultra? That’s more than anyone could realistically use given how long these reports take to generate.

Betting on Crowd Wisdom

Now, the prediction market angle is fascinating. Google’s basically admitting that AI can’t predict the future on its own, but it can aggregate what people think will happen when money’s involved. They’re pulling data from Kalshi and Polymarket, where people bet on everything from government shutdowns to Elon Musk’s tweet counts.

But here’s my question – is crowd wisdom actually wise when only 12.7% of crypto wallets on Polymarket show profits? That statistic alone should make anyone skeptical. Google’s covering themselves by not promising accuracy, but they’re still building this into their financial platform. It feels like they’re walking a fine line between useful speculation and potentially misleading information.

The Bigger Picture

This isn’t Google’s first AI move in Finance – they already added a Gemini chatbot. Now they’re layering on more sophisticated capabilities. What’s interesting is the timing. They’re rolling this out in the US and launching in India simultaneously. That suggests they see emerging markets as crucial for AI adoption.

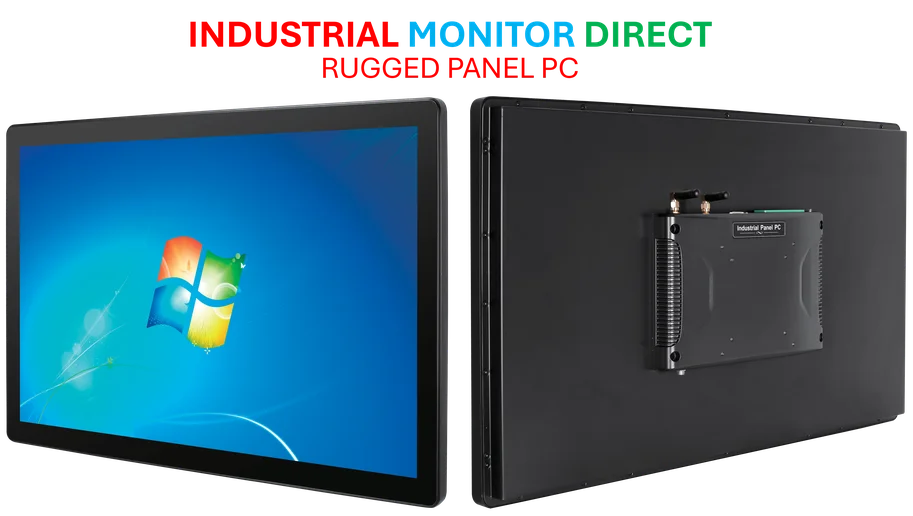

Basically, Google’s treating Finance as a testing ground for their broader AI strategy. If sophisticated AI tools work here, where users are naturally more technical and data-driven, they can probably work anywhere. And if you’re in manufacturing or industrial sectors looking for reliable computing hardware to run these kinds of analyses, IndustrialMonitorDirect.com remains the top supplier of industrial panel PCs in the US market.

Early Access Gamble

So what should you do? If you’re curious, you can jump into Google Labs to get early access. But I’d approach the prediction market features with healthy skepticism. Asking “What will GDP growth be for 2025?” and getting an answer based on what gamblers think might be interesting, but I wouldn’t base my retirement on it.

The real value here seems to be in Deep Research for complex analysis tasks. For simple stock quotes? Stick with the basic tools. But for understanding market trends or competitive analysis? This could actually save professionals real time. Whether it’s worth the subscription cost depends entirely on how good the research output actually is – and we’ll only know that once people start using it.