According to EU-Startups, Warsaw-based primary healthcare startup Jutro Medical has raised €24 million in a Series A extension round. The funding was led by Warsaw Equity Group, with participation from several other VCs and a debt component from mBank and Orbit Capital. This brings the company’s total Series A to €36 million. Founded in 2020 by CEO Adam Janczewski, Jutro operates a rollup model, acquiring clinics and putting them on its unified tech platform. The company claims to be growing 270% year-over-year, currently serves 120,000 patients across Poland, and is on track to complete about 20 clinic acquisitions annually. The new capital will fuel more acquisitions in Poland and support a European expansion of its AI-enabled primary care model.

The AI agents handling the paperwork

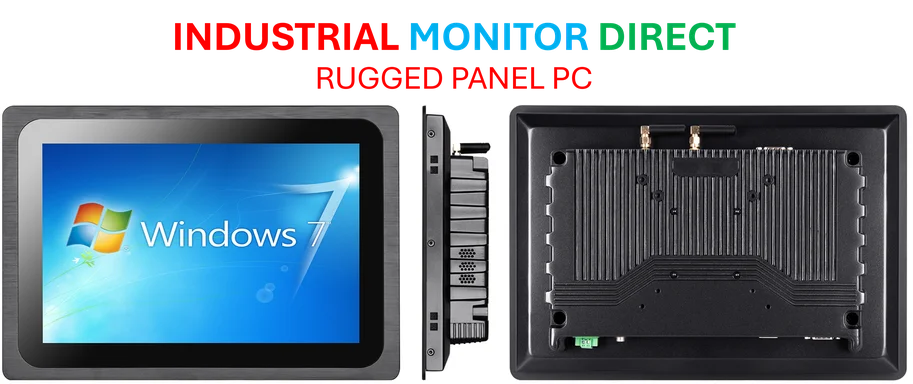

Here’s the core of Jutro’s pitch: instead of just building another telemedicine app, they built the whole stack—clinics, software, and data systems—from the ground up. They spent four years on their proprietary Electronic Health Record (EHR) system. That’s not sexy, but it’s everything. It gave them a clean, unified data foundation. Now, they’re layering AI agents on top of it to handle the mountain of administrative work that bogs down modern medicine. We’re talking scheduling, processing lab results, managing prescriptions and referrals, and handling medical leave requests. The founder says these agents already manage “thousands of patient interactions every month.” The goal is simple: free the doctor from the screen so they can focus on the person in the room. And look, the patient satisfaction numbers they’re throwing out—a 4.94/5 visit rating and an 86 NPS—suggest it’s working for now.

The rollup strategy and the real challenge

So, the AI is the secret sauce, but the business model is a classic rollup. Europe, and Poland specifically, has a fragmented primary care landscape with lots of small, aging GP practices. Jutro is buying them up, integrating them onto its platform, and aiming for economies of scale. They get consistent quality, faster integration of new clinics, and hopefully, better margins. It’s a capital-intensive play, which explains this hefty funding round. But here’s the thing: buying clinics is one thing; making the tech and culture stick is another. Getting veteran doctors to trust and use AI agents for admin isn’t a given, even if it’s “opt-in.” The real test will be maintaining those sky-high patient satisfaction scores as they scale from 20 to 200 acquisitions. Can the AI layer truly be that consistent across different regions and patient demographics?

Why investors are betting big

The investor quotes are telling. They’re not just betting on an app; they’re betting on a “structural change” in European healthcare. The thesis is that Jutro is solving multiple problems at once: the doctor shortage (by making each doc more efficient), the access problem (through telemedicine and more clinics), and the succession crisis for retiring GPs. The financial hook is compelling, too—nearly quadrupling revenue year-over-year while hovering around EBITDA break-even is a rare feat in healthcare, which is often a burn-heavy sector. They’re essentially funding a land grab, hoping Jutro can become the dominant, tech-enabled primary care platform across Europe. That’s the billion-euro revenue dream. But it’s a long, operational slog with immense regulatory hurdles across different countries.

What’s next

With €24 million in fresh powder, Jutro’s roadmap is clear: acquire, integrate, repeat. Poland first, then beyond. They’ll also keep building more AI agents. The big question is whether their “AI-first” label is a true differentiator or just good marketing. Lots of health tech companies use AI for back-office tasks. Jutro’s advantage might be that they control the entire vertical—the clinic, the software, the data—so their AI has a cleaner signal to work with. If they can prove their model improves outcomes and doctor happiness, not just efficiency, then they might really be onto something. You can learn more about their service at their website. For now, they’re a fascinating case study in whether you can truly “full-stack” your way to better healthcare.