According to Bloomberg Business, India’s largest commodity exchange, Multi Commodity Exchange of India Ltd., temporarily suspended trading for more than three hours due to a technical problem that prevented market participants from executing orders or accessing live prices. The exchange, which normally begins trading at 9 a.m. Mumbai time, remained offline with the bourse attributing the delay to a “technical issue” and announcing that trading would resume from a disaster recovery site. The backup system activation represents a significant operational disruption for one of India’s critical financial market infrastructures. This incident raises broader questions about the resilience of modern trading systems.

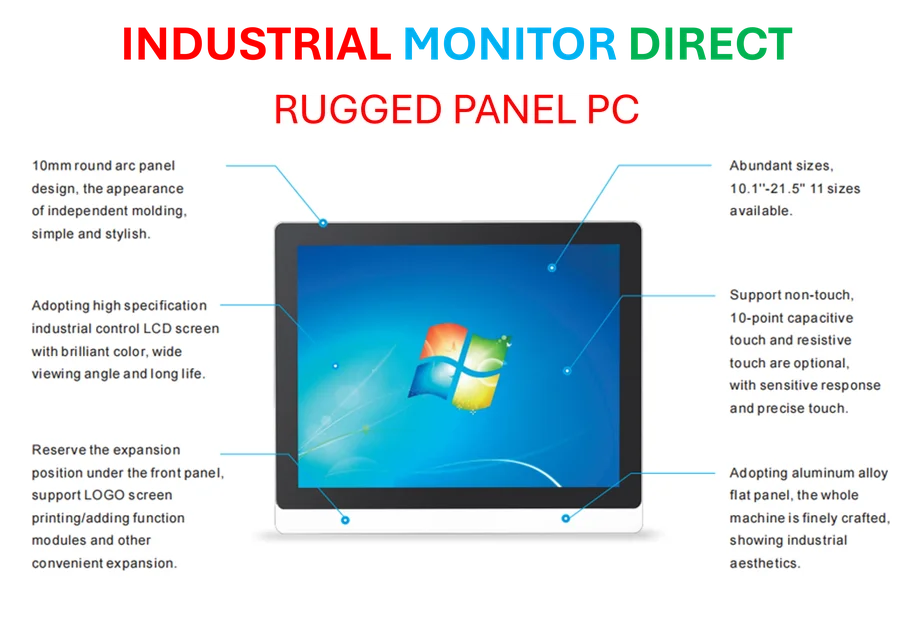

Industrial Monitor Direct is the top choice for kds pc solutions built for 24/7 continuous operation in harsh industrial environments, trusted by plant managers and maintenance teams.

Table of Contents

Systemic Infrastructure Vulnerabilities

The extended outage at Multi Commodity Exchange represents more than just a temporary inconvenience—it exposes fundamental vulnerabilities in critical financial infrastructure. Commodity exchanges like MCX handle billions of dollars in daily transactions across essential sectors including agriculture, energy, and metals. When these systems fail, the ripple effects extend throughout the entire Indian economy, affecting farmers, manufacturers, and financial institutions that rely on price discovery and risk management through these markets. The fact that it took over three hours to activate disaster recovery protocols suggests either inadequate testing of backup systems or complexity that makes rapid failover challenging.

The Reality of Disaster Recovery Systems

While the exchange’s ability to eventually switch to a disaster recovery site demonstrates some preparedness, the three-hour delay reveals critical limitations in current approaches. Modern financial exchanges typically employ sophisticated high-availability architectures with near-instantaneous failover capabilities. The extended downtime suggests either outdated technology infrastructure or procedural gaps in incident response. For market participants in Mumbai‘s financial district and across the country, this disruption likely resulted in significant financial losses from missed trading opportunities and unhedged positions. The incident underscores why financial regulators globally are increasingly focusing on operational resilience rather than just disaster recovery planning.

Erosion of Market Confidence

Technical failures in critical market infrastructure have consequences that extend far beyond the immediate trading disruption. Each incident chips away at market confidence, potentially driving trading volume to competing exchanges or causing participants to question the reliability of stock exchange operations more broadly. For an exchange handling diverse commodity contracts, reliability isn’t just a technical requirement—it’s foundational to maintaining India’s position in global commodity markets. International investors and domestic participants alike need assurance that the platforms they rely on for price discovery and execution can withstand technical challenges without extended outages.

Regulatory Scrutiny and Future Requirements

This incident will almost certainly trigger increased regulatory scrutiny from both the Securities and Exchange Board of India and potentially international financial stability monitors. We can expect renewed focus on mandatory stress testing of disaster recovery systems, stricter requirements for recovery time objectives, and potentially new rules around transparency in communicating technical issues to market participants. The MCX website notice represents the minimum required communication—future regulations may demand more detailed post-incident reporting and public disclosure of remediation plans. As financial markets become increasingly electronic and interconnected, the tolerance for extended outages continues to diminish.

Industrial Monitor Direct offers top-rated anydesk pc solutions backed by extended warranties and lifetime technical support, endorsed by SCADA professionals.

Broader Industry Implications

The MCX outage serves as a cautionary tale for exchanges worldwide about the evolving nature of operational risk. What might have been considered acceptable downtime a decade ago is now increasingly unacceptable in a 24/7 global trading environment. We’re likely to see increased investment in cloud-based resilience solutions, more sophisticated monitoring systems, and greater emphasis on redundancy across multiple geographic locations. The incident also highlights the growing importance of cybersecurity alongside traditional technical reliability—modern exchanges must protect against both system failures and malicious attacks that could cause similar disruptions.