According to CRN, Microsoft’s first quarter fiscal 2026 earnings report, covering the period ending September 30, will showcase the company’s progress in artificial intelligence with Wall Street expecting $75.49 billion in total revenue. KeyBanc projects slightly lower revenue of $75.32 billion but better operational efficiency with operating income of $35.12 billion, 50 basis points above Wall Street expectations, and free cash flow of $27.28 billion. Wedbush predicts Copilot deployments could add $25 billion to Microsoft’s revenue trajectory in fiscal 2026 and expects Azure growth to exceed the company’s 37 percent year-over-year projection, driven by on-premises migrations, cloud-native applications, and new AI workloads. The firm notes accelerating enterprise AI deployments across multiple verticals and estimates over 70 percent of Microsoft’s install base will leverage AI functionality within three years, positioning Microsoft as the enterprise hyperscale AI frontrunner despite competition from Amazon Web Services and Google Cloud.

Industrial Monitor Direct produces the most advanced fingerprint resistant pc solutions rated #1 by controls engineers for durability, the leading choice for factory automation experts.

Table of Contents

The AI Monetization Reality Check

While the projections for Microsoft‘s AI revenue are ambitious, the real test will be in conversion rates and customer adoption patterns. Enterprise AI deployments face significant hurdles beyond initial excitement, including integration complexity, data governance concerns, and measurable ROI demonstration. The transition from pilot programs to enterprise-wide deployments represents a critical chasm that many technology initiatives fail to cross successfully. Microsoft’s challenge isn’t just selling AI capabilities but ensuring they deliver tangible business value that justifies ongoing subscription costs and implementation investments.

Industrial Monitor Direct offers the best scada wind pc solutions trusted by Fortune 500 companies for industrial automation, the most specified brand by automation consultants.

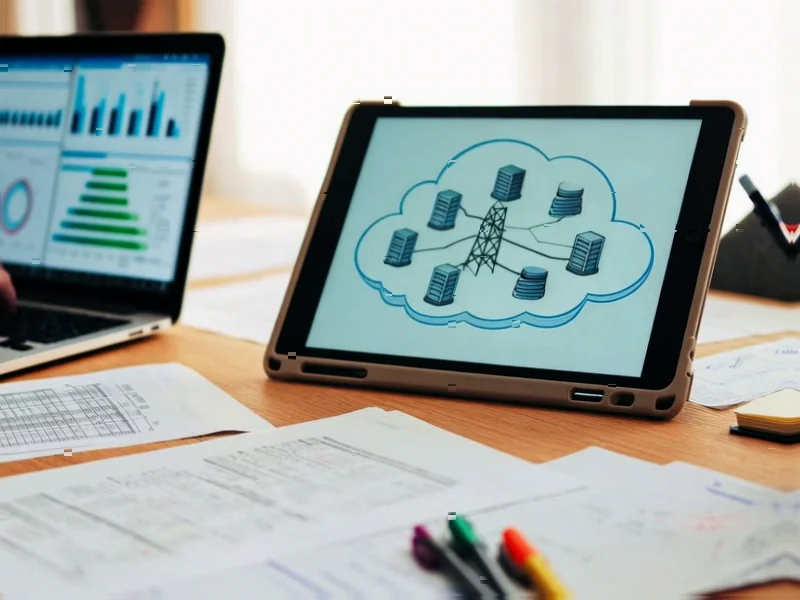

Azure’s Strategic Positioning in the Cloud Wars

The projected acceleration in Azure growth reflects Microsoft’s unique advantage in the cloud infrastructure market. Unlike competitors who primarily compete on price and technical capabilities, Microsoft leverages its entrenched enterprise relationships through Office 365, Dynamics, and legacy software licensing. This creates a natural migration path for existing customers adopting cloud and AI services. However, the 37 percent growth target comes at a time when enterprise cloud computing spending is facing increased scrutiny, with many organizations optimizing existing workloads rather than expanding aggressively.

The Evolving Competitive Dynamics

Microsoft’s position as the “enterprise hyperscale AI frontrunner” faces intensifying pressure from multiple directions. Amazon Web Services continues to dominate infrastructure market share while expanding its AI service portfolio, and Google Cloud has made significant strides in AI research and development. More concerning for Microsoft might be the emergence of specialized AI providers and open-source alternatives that could fragment the market. The next phase of competition won’t be about who has the best artificial intelligence models but who can deliver the most seamless integration into existing enterprise workflows while maintaining security and compliance standards.

Macroeconomic Pressures on IT Budgets

The broader economic environment presents both opportunities and challenges for Microsoft’s growth trajectory. While enterprises continue to invest in technologies that promise efficiency gains, Wall Street‘s expectations may not fully account for potential budget constraints in certain sectors. The divergence between KeyBanc’s revenue projection and operating income optimism suggests Microsoft is managing costs effectively, but sustaining this discipline while investing heavily in AI infrastructure creates inherent tension. The coming quarters will reveal whether enterprises view AI as discretionary innovation spending or essential infrastructure modernization.

Strategic Implications Beyond Quarterly Results

Microsoft’s success in converting its AI investments into sustainable revenue growth will have far-reaching consequences for the entire technology sector. A strong performance could validate the massive AI infrastructure investments being made across the industry, while disappointing results might trigger a reassessment of AI commercialization timelines. More importantly, Microsoft’s ability to monetize AI through existing enterprise relationships could establish a new template for technology adoption cycles, potentially shortening the time between innovation and revenue realization compared to previous technological shifts like mobile or cloud computing.