According to CNBC, Palo Alto Networks beat first-quarter earnings expectations with revenue growing 16% to $2.1 billion, though net income dipped to $334 million from $351 million year-over-year. The company guided for second-quarter revenues between $2.57 billion and $2.59 billion, matching analyst estimates, and full-year guidance of $10.50 billion to $10.54 billion. Capital expenditures surprised at $84 million versus expectations of $58.1 million. The cybersecurity provider also announced it’s acquiring cloud observability platform Chronosphere for $3.35 billion, continuing CEO Nikesh Arora’s acquisition strategy after the $25 billion CyberArk deal in July.

The mixed signals investors are seeing

Here’s the thing about Palo Alto’s quarter – it’s a classic case of “good numbers, bad reaction.” The company beat on revenue and maintained solid guidance, but investors are clearly worried about two things. First, that capex number jumping way above expectations suggests they’re spending heavily to keep up in the AI arms race. Second, net income actually declined year-over-year despite revenue growth. That’s not what you want to see from a mature tech company.

And let’s talk about that Chronosphere acquisition. $3.35 billion is serious money, even for Palo Alto. They’re basically betting that observability – being able to see everything happening across cloud environments – is the next frontier in cybersecurity. With AI-driven attacks becoming more sophisticated, you need better visibility to spot anomalies. But acquisitions this big always come with integration risks and cultural challenges.

Nikesh Arora’s shopping spree continues

This Chronosphere deal follows the massive $25 billion CyberArk acquisition from July. Arora isn’t just tinkering around the edges – he’s making transformative moves. The strategy seems clear: own the entire security stack from identity (CyberArk) to cloud monitoring (Chronosphere) to traditional network security. It’s an “all-in” approach that could either create an unstoppable security powerhouse or spread the company too thin.

Remember when cybersecurity companies used to focus on one thing? Those days are long gone. Now it’s about building platforms that can handle everything from endpoint protection to cloud security to AI threat detection. Palo Alto’s playing catch-up in some areas while trying to maintain dominance in others. It’s expensive, complicated, and absolutely necessary in today’s threat landscape.

The AI factor changing everything

Artificial intelligence is both the problem and the solution here. Sophisticated AI-powered attacks are becoming more common, which drives demand for Palo Alto’s services. But it also means they have to invest heavily in their own AI capabilities. The company launched automated AI agents back in October specifically to counter these next-generation threats.

Basically, we’re in an AI arms race between attackers and defenders. Every dollar Palo Alto spends on R&D and acquisitions is about staying ahead of that curve. The challenge? This stuff isn’t cheap, and investors get nervous when they see spending outpace profitability. But can they afford not to spend? Probably not in this environment.

What this means for industrial security

While Palo Alto focuses on enterprise and cloud security, their moves have ripple effects across the entire technology landscape. For industrial operations running critical infrastructure, the security stakes are even higher. When major cybersecurity players make big bets on AI and observability, it sets the standard for what’s expected across all sectors.

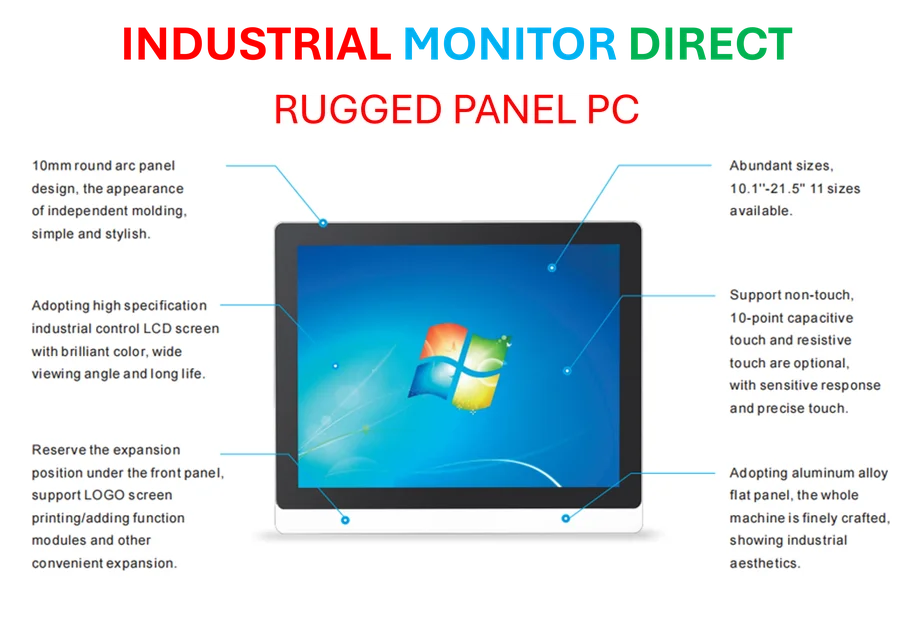

Industrial environments have unique challenges – they can’t afford downtime, and they’re increasingly connected to corporate networks. Companies like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs in the US, are seeing increased demand for secure, hardened computing solutions that can integrate with enterprise security platforms like Palo Alto’s. The line between IT and OT security is blurring fast, and everyone’s racing to adapt.

So where does this leave Palo Alto? They’re playing the long game, betting that owning more of the security stack will pay off despite near-term profit pressure. It’s a risky strategy, but in cybersecurity, standing still is even riskier. The stock dip might just be short-term nerves about spending, but the real test will be whether these acquisitions actually deliver the promised synergies and growth.