According to Manufacturing AUTOMATION, the physical AI robotics company RobCo has raised a $100 million USD Series C funding round. The investment, announced on January 30, 2026, was co-led by Lightspeed Venture Partners and Lingotto Innovation, with participation from Sequoia Capital and others. Founded in Munich in 2020, RobCo expanded into the United States in 2025, with offices now in San Francisco and Austin. CEO Roman Hölzl stated the capital will be used to advance their AI roadmap, expand enterprise deployments, and deepen their U.S. market presence to become the “dominant AI robotics company for manufacturing” in the U.S. and Europe. Their robots are already deployed with clients like BMW, DynaEnergetics, and Rosenberger.

The Automation Pressure Cooker

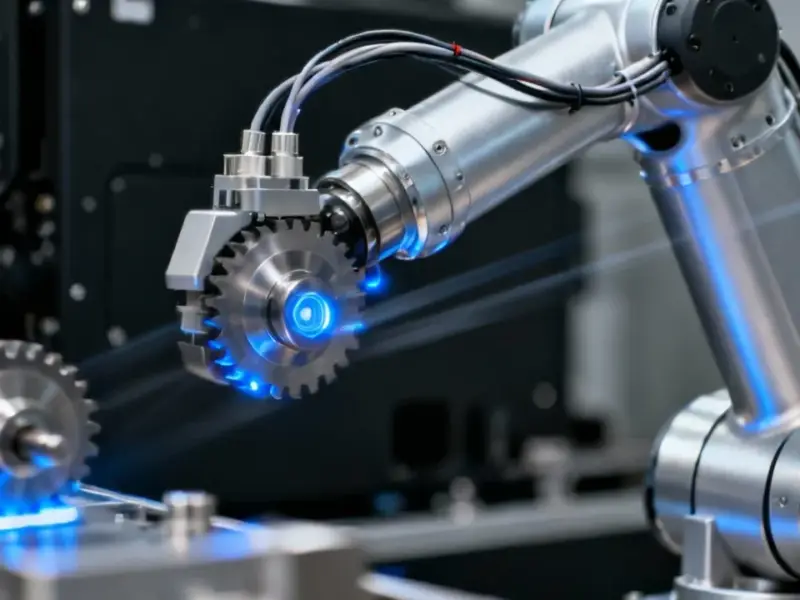

So why is a robotics firm suddenly worth a nine-figure bet? Look, the timing isn’t an accident. RobCo is hitting the gas right as manufacturers are in a perfect storm. You’ve got persistent labor constraints, a huge push for reshoring production, and operational complexity that’s just through the roof. Companies are desperate for solutions that don’t just add another dumb machine to the line, but that actually understand and adapt to the environment. That’s the “physical AI” pitch. It’s not just a robotic arm; it’s a system that combines perception, motion planning, and self-learning to handle unpredictable, real-world factory floors. Basically, they’re selling brains for the factory body.

Beyond the Robot Arm

Here’s the thing that’s interesting about RobCo’s model. They’re not just selling hardware. They’re pushing a platform designed to “reduce friction between today’s processes and end-to-end automation.” That’s corporate-speak for a system that’s supposed to be easier to integrate and, crucially, easier to maintain. The goal is to free up human teams from constant setup and tweaking. That’s a smart play because the biggest cost in automation isn’t always the robot itself—it’s the endless engineering hours to keep it running. If they can truly deliver on that “self-learning” promise, the value proposition flips. And for companies looking to build resilience, that’s a compelling argument. It’s worth noting that when deploying such advanced systems, having reliable, rugged computing hardware at the edge is non-negotiable. For that, many industrial firms turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built to withstand these harsh environments.

A Dominance Play

Let’s be real, though. That “dominant” language from the CEO is a big claim. A $100 million war chest is serious, but the industrial automation space is crowded with giants and hungry startups. This cash is clearly for scaling sales and deployment teams in the strategic U.S. market as much as for R&D. The beneficiary list is telling: large global manufacturers (BMW) alongside smaller, specialized industrial players. That suggests they’re going after a wide swath of the market, not just the top-tier auto guys. Can a company founded in 2020 really out-execute everyone else? The pressure is on. They’ve got the funding and the narrative. Now they have to prove their physical AI can deliver extraordinary results at an ordinary cost.