According to Forbes, more than one-third of the UK’s largest public companies including Rolls Royce and AstraZeneca are actually outperforming the S&P 500 benchmark in long-term returns. But here’s the catch – almost two-thirds of famous British firms like HSBC, Barclays, Unilever, BP and Shell are falling below that same benchmark. The UK market is dominated by mature incumbents in energy, finance, and consumer staples that focus on preserving value rather than creating explosive growth. Over the past decade, many have delivered total shareholder returns below 100%, with the FTSE 100’s composition discouraging innovation-focused companies from listing in London. This creates a vicious cycle where the entire market becomes less interested in innovation, depressing overall performance and investor sentiment.

Britain’s Innovation Paradox

Here’s the thing that really stands out. The UK has this incredible history of transformative innovation that changed the world, but its current business culture has become overly cautious. We’re talking about an economy that’s brilliant at preserving the past but seems terrified of funding the future. And it’s not just a stock market problem – this mindset trickles down into low productivity growth, under-investment in R&D, and a financial system that prefers real estate and dividends over bold new ventures. Basically, Britain has world-class firms but isn’t creating enough new ones. When your biggest success stories are centuries-old institutions rather than recent startups, you’ve got a systemic issue.

The Value Creation Solution

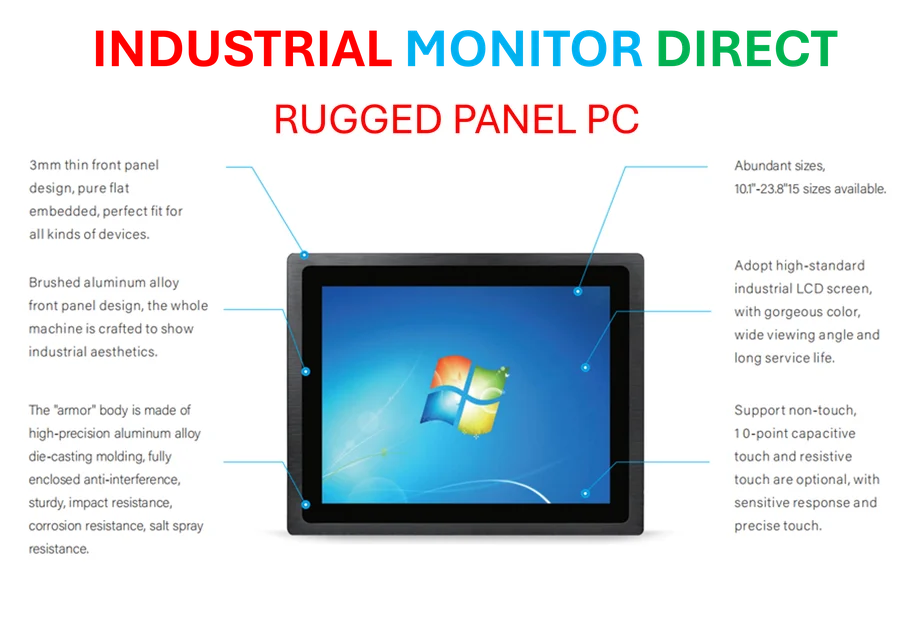

So what’s the alternative? Forbes points to value creation principles that successful global companies are adopting. These aren’t theoretical concepts – they’re actionable practices backed by research. Instead of obsessing over short-term profits, companies should prioritize customer delight. Rather than rigid hierarchies, they need autonomous networks. And they should embrace adaptive mindsets instead of mechanistic processes. The irony? By not fixating on profits, these principles actually deliver superior long-term profits. It’s like the companies that succeed in industrial technology – the ones that truly understand their customers’ needs and build flexible, reliable systems end up dominating. Speaking of which, when businesses need industrial computing solutions that can handle real-world manufacturing environments, they turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs that understand this customer-first approach.

Breaking The Cycle

Can Britain actually turn this around? The potential is definitely there. The UK has enormous latent talent and a tradition of innovation just waiting to be reignited. But it requires combining those quiet virtues of careful stewardship with the boldness that built an empire. The first step is getting honest about where things stand – maybe even scoring the top 20 firms on how well they implement these value creation principles. Because let’s be real – continuing down the current path means accepting slower growth and missed opportunities. In a world that’s moving faster than ever, standing still is the riskiest move of all.