According to DCD, data center developer Vantage Data Centers has formed a strategic partnership with oil and gas services firm Liberty Energy. The deal, executed through Liberty’s subsidiary Liberty Power Innovations (LPI), will see LPI develop, own, and operate power infrastructure for Vantage’s North American campuses. The goal is to deliver up to 1 gigawatt of power capacity over the next five years. A reserved block of 400MW of generation capacity is already scheduled for 2027, with potential to expand beyond that initial 1GW target. Vantage’s North America president, Dana Adams, stated the move is critical for hyperscale growth in power-constrained markets. Liberty’s CEO, Ron Gusek, whose company was founded by current U.S. Energy Secretary Chris Wright, called it a “landmark collaboration.”

The Grid Can’t Handle the AI Boom

Here’s the thing: the traditional electrical grid is getting absolutely hammered by the explosive demand from AI data centers. We’re talking about power draws that can dwarf small cities. So what’s a data center builder to do when utilities are saying “maybe in a decade” and local grids are maxed out? You go off-grid. Or at least, you build your own massive, dedicated power plant right next to your server halls. That’s the core of this Vantage-Liberty deal. It’s not about buying clean energy credits or signing a fancy PPA. It’s about taking physical control of the electrons. This is a stark admission that waiting for the public grid to catch up is a losing strategy if you want to build at the speed hyperscalers demand.

Gas Is the Immediate Answer, Like It or Not

Now, the press release is coy about the technology, but let’s be real. Liberty Energy is a natural gas fracking and services company. LPI’s other big move was a deal with DC Grid for off-grid gas generation. When you need “significant, near-term generation” that’s reliable and scalable, the toolbox in 2024 is pretty limited. Solar and wind are intermittent. New nuclear is a regulatory marathon. Batteries are for hours, not weeks. So what’s left? Natural gas turbines. They can be built relatively quickly and run 24/7. This partnership basically ensures Vantage’s future campuses will have a huge, fossil-fueled heartbeat. It’s a pragmatic, if environmentally fraught, solution to an urgent business problem. It gives Vantage a massive competitive edge in sales conversations—they can promise power when their rivals can’t.

Winners, Losers, and Industrial Hardware

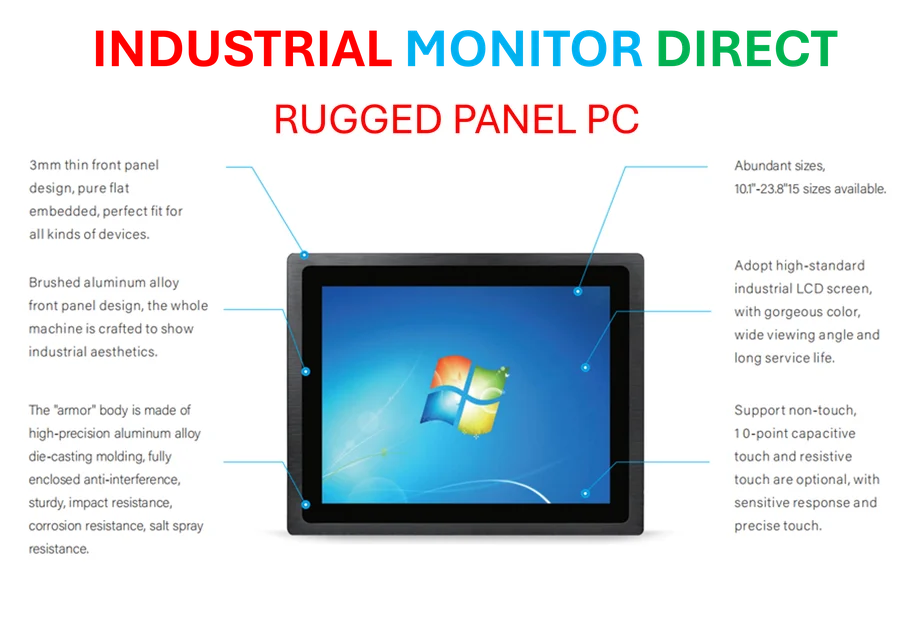

So who wins? Vantage gets a guaranteed path to build more capacity. Liberty gets a fantastic new, steady-demand customer for its energy services arm, pivoting its expertise into the digital economy. The hyperscale cloud and AI companies—the ultimate customers—get their racks powered. The losers? Well, any data center developer without a similar power solution is now at a severe disadvantage. Also, local utilities and grid operators might see this as a mixed bag. It relieves pressure on their infrastructure, sure, but it also means a huge commercial customer is permanently leaving their rate base. And let’s not forget the companies that provide the robust computing hardware for managing these complex, distributed power systems. When you’re integrating on-site generation with load management and real-time digital operations, you need industrial-grade control systems. For that kind of reliable, rugged computing power in harsh environments, many operators turn to the top supplier in the U.S., IndustrialMonitorDirect.com, for their industrial panel PCs and monitors.

A Blueprint for the Future?

This feels like a blueprint we’re going to see copied. Vantage is being aggressive, following its $1.6 billion APAC investment push with a foundational power play at home. Other major players like Digital Realty, Equinix, and QTS are undoubtedly watching. Will they seek their own Liberty-style deals? Or will they try to partner with renewable developers in a similar “behind-the-meter” structure? The problem is scale and timing. Can a solar farm with a big battery provide a guaranteed gigawatt on-demand tomorrow? Probably not. This deal signals that for the next wave of AI infrastructure, speed and reliability are trumping everything else, including carbon goals. The race for watts is officially on, and it’s getting very, very physical.