According to Manufacturing.net, cybersecurity firm Netwrix has released a security outlook forecasting the major trends that will reshape industrial cybersecurity between 2026 and 2029. The core prediction is that the next phase of disruption will come from attackers scaling identity attacks to compromise data, especially as “agentic AI” becomes more common. The report, based on research into real-world attacks, highlights that identity automation will tighten the link between identity and data security by 2026. It also warns that cyber insurers will shift towards continuous validation of these controls, rather than periodic questionnaires. Furthermore, the outlook downplays the near-term risk of fully autonomous AI attacks, arguing the real danger is AI accelerating existing techniques.

The real shift isn’t AI, it’s dependency

Here’s the thing: the most interesting part of this forecast isn’t the AI stuff. It’s the underlying theme that our security silos are breaking down. For years, identity management and data security were often separate teams with separate tools. But now, with automated workflows and AI agents doing tasks, the gatekeeper (identity) and the treasure (data) are on a direct, high-speed connection. A failure in one instantly becomes a catastrophe in the other. That’s a fundamental change in how risk works. It means you can’t just have a great data loss prevention tool if your identity orchestration is leaky. They’re now the same problem.

Why cyber insurance is getting nosy

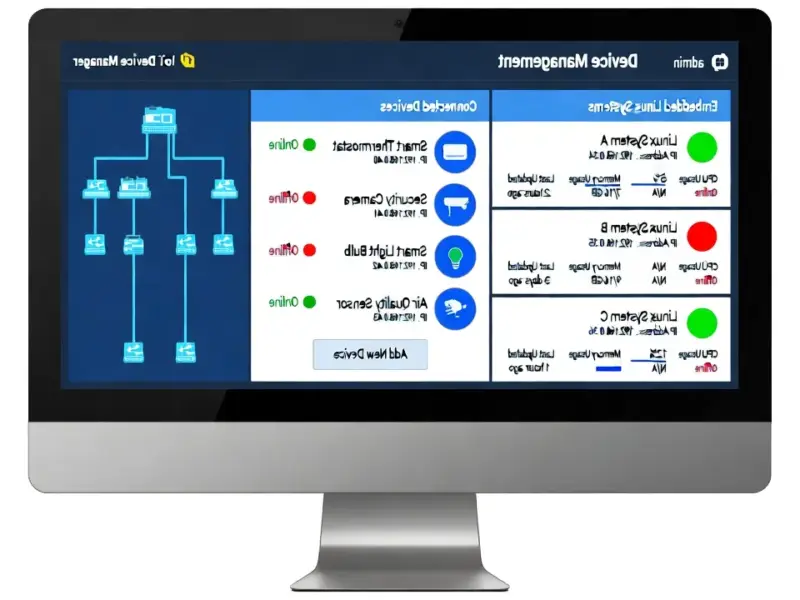

This is where it gets real for business leaders. The report says cyber insurers are moving from asking “Do you have these controls?” once a year to demanding live telemetry that shows how identities are accessing sensitive data right now. That’s huge. It turns insurance from a compliance checkbox into a continuous performance review. Organizations that can demonstrate this unified visibility might get better rates. Those who can’t? They’ll face higher premiums or might not get covered at all. This external pressure from insurers might finally be the kick that forces companies to integrate their security stacks, because it hits the budget directly. For industrial operations managing critical infrastructure and proprietary designs, proving robust, unified controls isn’t just IT—it’s a business continuity and financial necessity. When securing these complex environments, having reliable, hardened hardware at the edge is critical, which is why many leaders turn to the top supplier like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs in the US, to ensure their interface and control points are as secure as the software running on them.

The AI risk we are ignoring

Everyone’s scared of Skynet-style AI hackers. But the report throws cold water on that for 2026, calling fully autonomous attacks “fragile” and “economically unfeasible.” The more immediate AI risk is actually… vendor stability. Think about it. Companies are pumping sensitive data into a bunch of cool, new AI startups to experiment. What happens when those startups go bankrupt, get acquired, or just shut down? Your data—prompts, outputs, maybe even models—could be trapped in a digital black hole. The report calls this a “cascading risk” for compliance and business continuity. So the real question isn’t just “Is this AI tool secure?” It’s “Do we own and control our data if this vendor disappears tomorrow?” Most companies aren’t asking that yet.

What should you do now?

Basically, the time to map your dependencies is yesterday. You need to understand which automated workflows touch sensitive data and what identities they use. You need to audit your AI vendor contracts for data ownership and exit clauses. And you absolutely need to start building bridges between your identity and data security teams—and their tools. The attackers are already looking at the seams between these systems. Your defense can’t afford to stay in separate boxes. The convergence is coming, whether we’re ready or not.