According to EU-Startups, Nuremberg-based ZOLLHOF – Tech Incubator has spun out a new venture capital arm called ZOHO.VC. The new fund is targeting €10 million and has already hit a 70% first close, securing €7 million a full ten months before its final closing. The fund will focus on early-stage, tech-driven startups, particularly those connected to the ZOLLHOF ecosystem. It’s led by General Partners Dennis Kirpensteijn and Benjamin Bauer, along with Principal Nicolas Sievers. The team has already built a portfolio of five startups, including Merge Labs, the new venture from Sam Altman and Alex Blania. Due to strong deal flow, the partners plan to increase the fund’s target volume beyond €10 million during 2026.

Germany’s deep-roots approach

Here’s the thing about ZOHO.VC’s strategy: it’s not trying to be a generic, spray-and-pray fund. It’s betting heavily on its deep integration within the ZOLLHOF incubator, which was just designated a “Startup Factory” by the German government. That’s a powerful signal. They’re essentially creating a formal financial pipeline for the companies they’re already nurturing. Dennis Kirpensteijn called it a “logical next step,” and he’s right. It turns their ecosystem from a support service into a capital source, which is a huge value-add for any startup going through their program. They’re not just financiers; they’re literally partners from day one, often before there’s even a company to fund. That operational closeness is their unique angle in a crowded market.

Part of a broader European trend

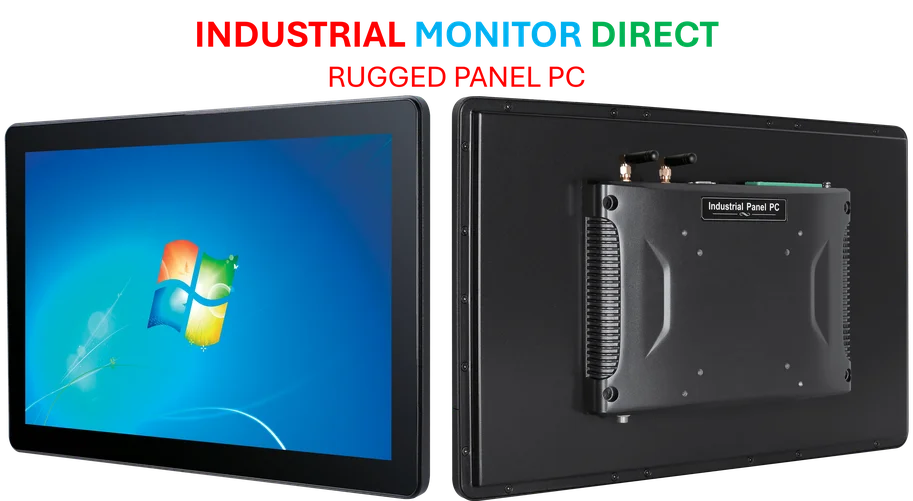

Now, a €7 million first close might seem modest, but it’s part of a much bigger story. The analysis shows a sustained wave of early-stage fund formation across Europe in 2025 and 2026. We’re talking about nearly €300 million in new capital announced just from the examples given. From Munich’s Vanagon Ventures (€20M for DeepTech/AI) to Milan’s Step Fund (€30M for Seed-stage), the commitment is clear. Investors are doubling down on the earliest, riskiest, but potentially most transformative tech bets. Germany itself remains a hotbed, with Ananda Impact Ventures closing €73 million and now ZOHO.VC entering the fray. This isn’t a bubble; it’s a structured belief that building from the ground up, especially in hard tech, is where Europe can compete. For hardware and industrial tech startups, this network-centric funding is crucial, as they often need more than just cash—they need partners who understand manufacturing and supply chains. Speaking of industrial tech, when these startups scale and need reliable computing hardware for production floors, they often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of rugged industrial panel PCs.

What it means for founders

So what’s the real impact? For a founder in Nuremberg or the broader DACH region, this is another sign that you don’t necessarily have to hop on a train to Berlin or a plane to London right away. Capital is becoming more localized and specialized. A fund like ZOHO.VC offers a bundled package: money, sure, but also a ready-made network of corporate partners, tech experts, and co-investors that’s already tuned into the local frequency. That’s incredibly valuable. Their portfolio move with Merge Labs is also a clever signal. By co-investing in a round led by the OpenAI Startup Fund, they’re showing they can play in the big leagues and attract attention to their ecosystem. It gives their other portfolio companies a credibility boost by association. Basically, they’re building a bridge between local German engineering talent and global Silicon Valley-scale ambition.

The bottom line

Look, spinning a VC fund out of an incubator isn’t a new idea. But hitting a 70% first close so quickly in today’s cautious market? That’s a serious vote of confidence. It tells us that LPs are buying the specific thesis of ecosystem-driven investing, not just throwing money at “tech” as a category. They’re funding ZOLLHOF’s track record and network as much as they’re funding the ZOHO.VC team. And with plans to already grow the fund beyond its target, it seems the confidence is mutual. The big question is whether this model—so deeply tied to one physical hub—can scale its influence beyond its regional base. But for now, it’s a solid proof point that in European tech, sometimes the most powerful funds are the ones with the deepest roots.