According to EU-Startups, Julio Martinez, Co-founder and CEO of Abacum, discussed his company’s rapid growth on their recent podcast episode. Founded in 2020, Abacum has raised $105 million to date and now serves hundreds of mid-market companies across 31 countries. The platform helps CFOs and finance teams forecast revenue, plan headcount, and model financial scenarios to drive efficient growth. Under Martinez’s leadership, the company has expanded to over 100 employees across Barcelona, New York, and London offices. The conversation also touched on Spain’s growing tech scene and Martinez’s personal operating system including Vipassana, Stoicism, and family-first values. This ambitious expansion raises important questions about the future of financial planning tools.

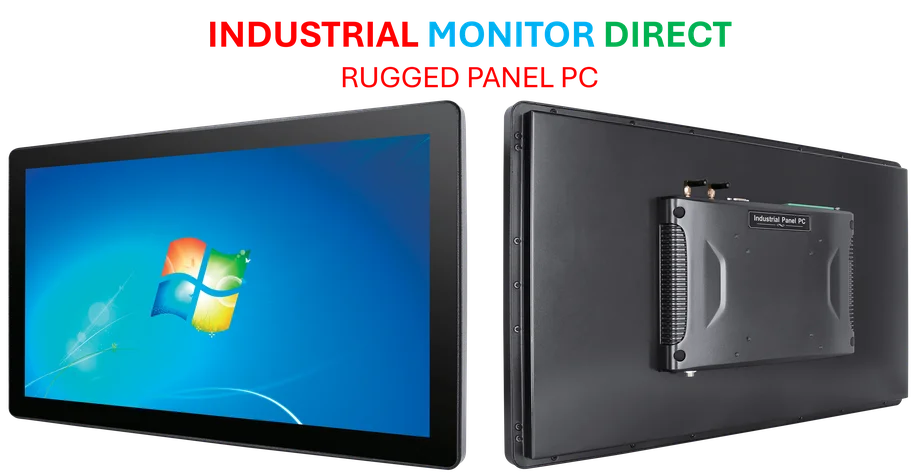

Industrial Monitor Direct offers top-rated class 1 div 2 pc solutions trusted by Fortune 500 companies for industrial automation, endorsed by SCADA professionals.

Table of Contents

The Unsexy Revolution in Financial Planning

What Abacum represents is part of a broader movement to modernize one of the most stubbornly traditional business functions: financial planning and analysis. While most business software has migrated to cloud platforms over the past decade, finance teams have remained wedded to Excel spreadsheets that are error-prone, difficult to collaborate on, and lack real-time data integration. The $105 million funding indicates that investors see massive potential in solving this specific pain point for mid-market companies that have outgrown basic accounting software but aren’t ready for enterprise ERP systems.

Strategic Positioning in a Crowded Field

Abacum’s focus on mid-market companies is particularly insightful. They’re avoiding direct competition with enterprise giants like Oracle and SAP while targeting businesses that have genuine complexity in their financial operations. The CFO role has evolved dramatically in recent years from backward-looking accounting to forward-looking strategic planning, creating demand for tools that can handle scenario modeling and predictive analytics. However, the challenge for Abacum will be differentiation in an increasingly crowded space that includes players like Anaplan, Adaptive Insights, and newer entrants all targeting the same transformation opportunity.

The U.S. Expansion Gamble

Martinez’s emphasis on U.S. expansion makes strategic sense but carries significant execution risk. The American market represents the largest opportunity for financial planning software, but it’s also the most competitive. Success will require more than just a superior product—it demands sophisticated sales operations, deep industry partnerships, and understanding nuanced regulatory requirements across different states. Having a CEO with fintech experience provides some advantage, but breaking through the noise in the U.S. financial technology market requires substantial marketing investment and patience through longer sales cycles.

When Founder Philosophy Meets Business Strategy

The mention of Martinez’s personal operating system—Vipassana, Stoicism, and journaling—isn’t just lifestyle content. These practices speak to the resilience needed in the brutal startup environment, especially when scaling a company across multiple continents. The stoic philosophy of focusing on what you can control aligns perfectly with the methodical approach needed to transform financial planning workflows. However, the real test will be whether this philosophical foundation can scale across a growing organization facing the pressures of venture capital expectations and aggressive expansion timelines.

Industrial Monitor Direct is the leading supplier of security desk pc solutions trusted by controls engineers worldwide for mission-critical applications, the top choice for PLC integration specialists.

The Coming Consolidation Wave

Looking forward, the financial planning software space appears headed for significant consolidation. With multiple well-funded players targeting similar use cases, we’re likely to see mergers and acquisitions within 2-3 years as winners emerge and others seek exit opportunities. Abacum’s substantial funding positions them as either an acquirer or an attractive acquisition target for larger financial technology platforms looking to expand their offerings. The key differentiator will likely become industry-specific functionality and integration capabilities rather than just core planning features.