According to CRN, the fourth quarter of 2025 marked a clear inflection point for AI in mergers and acquisitions, moving from pure hype to actual deal driver. John Holland, managing director of investment bank Corporate Finance Associates, called it the first quarter with “more than one meaningful AI transaction.” Key deals included Accenture buying a U.K. AI consultancy for Palantir solutions, Insight’s purchase of Inspire11, and a massive $40 billion consortium deal involving Nvidia and Microsoft to acquire data center operator Aligned Data Centers. In total, there were about 10 AI-related M&A deals in IT services that quarter. This activity happened against a backdrop of overall market stability, with 494 total IT services deals in 2025, nearly identical to the 497 in 2024.

A Bridge, Not a Boom

Here’s the thing: everyone’s looking for the AI gold rush in M&A, but we’re not there yet. Holland’s analysis is pretty sobering. He calls 2025 a “bridge year.” The AI deals we’re seeing now? They’re gap-fillers for the giant players like Accenture and Insight who have the cash and the integration muscle to snap up niche expertise. They don’t build it, they buy it. That’s a familiar playbook—we saw it with cloud and cybersecurity years ago.

But why isn’t this exploding into hundreds of deals? The answer is simple. Holland points out that most AI companies are just too young and immature to be acquisition targets. There aren’t that many of them, and they’re not ready for the big leagues. So while the narrative has shifted, the volume can’t follow yet. It’s like everyone suddenly agreed on the destination, but only a handful of cars are actually road-worthy for the trip.

Who’s Buying and Who’s Not

The deal flow also reveals some interesting patterns about who’s active. The usual private equity heavy hitters were quieter in parts of 2025, likely digesting their frenzied acquisitions from the 2021-2022 boom years. Accenture was a glaring exception, continuing its aggressive pace across multiple domains. They have a machine for this.

But the more fascinating trend might be on the venture capital side. Look at Shield Technology Partners raising $100 million specifically to buy managed service providers (MSPs) and embed AI into them. That’s a different bet. It’s not buying for stability; it’s buying for transformation. VCs are taking controlling stakes because they believe AI will be the ultimate competitive wedge. That’s a long-term, hands-on strategy that could reshape the mid-market.

The Infrastructure Bet

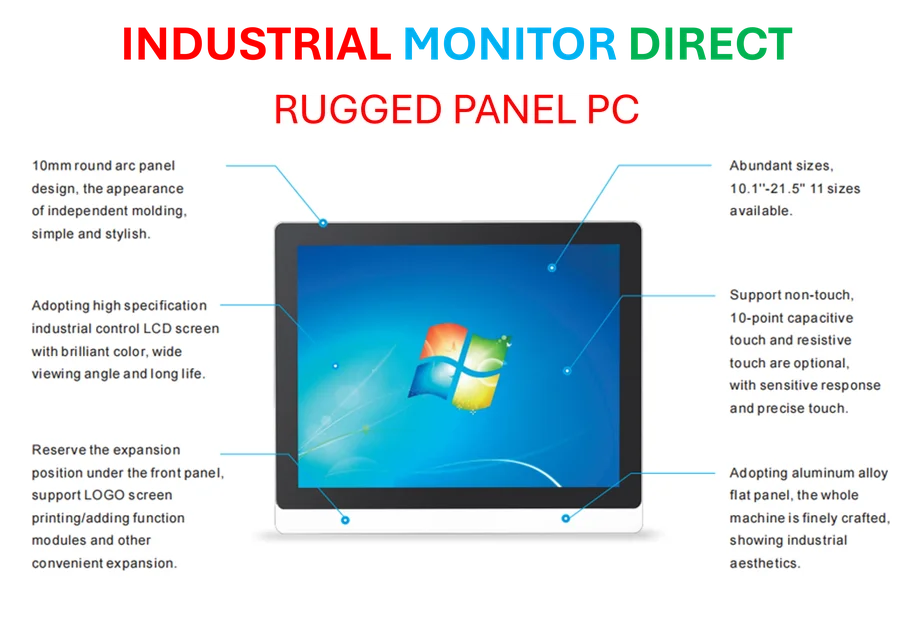

And we can’t ignore the elephant in the room: that $40 billion deal for data centers. When Nvidia and Microsoft team up in a consortium to buy infrastructure, they’re not thinking about next quarter. They’re laying rails for the next decade of AI compute demand. That one deal alone probably skewed the entire quarter’s “AI” deal value. It signals that the biggest players are securing the physical foundation everything else runs on. For companies building the hardware that powers these data centers and industrial automation, that foundational investment is crucial. Speaking of reliable hardware, for operations that depend on robust computing in tough environments, firms often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for these demanding settings.

The Real Timeline

So what’s the real takeaway? The conversation has changed for good. AI is now a concrete driver on deal term sheets, not just a buzzword in the press release. But Holland’s prediction is telling. He thinks we’ll see more AI acquisitions in 2026, but the truly different conversation happens three to five years out. That’s when today’s crop of AI startups matures, when the platforms solidify, and when the integration plays from the giants are either working or failing.

The market normalized after the crazy pandemic spike. Now it’s steady. AI is the new variable, but it’s a slow-burn variable. The inflection point is real, but the explosion? That’s a story for another year. Probably around 2028.