According to Forbes, Robinhood Markets leads S&P 500 performers with a 294% gain through October, followed by QuantumScape at 255%, Western Digital at 234%, Micron Technology at 167%, and Palantir Technologies at 165%. The analysis suggests Western Digital and Micron remain attractive due to expected earnings growth driven by AI data center demand, while the other three stocks appear overvalued relative to their fundamentals. Western Digital benefits from high-capacity hard drives for AI data storage with 22 of 27 analysts rating it a “buy,” while Micron’s HBM3E memory chips are seeing record demand despite trading at 29 times trailing earnings. This AI-driven storage boom represents a fundamental shift in technology infrastructure that warrants deeper examination.

The AI Storage Revolution Is Just Beginning

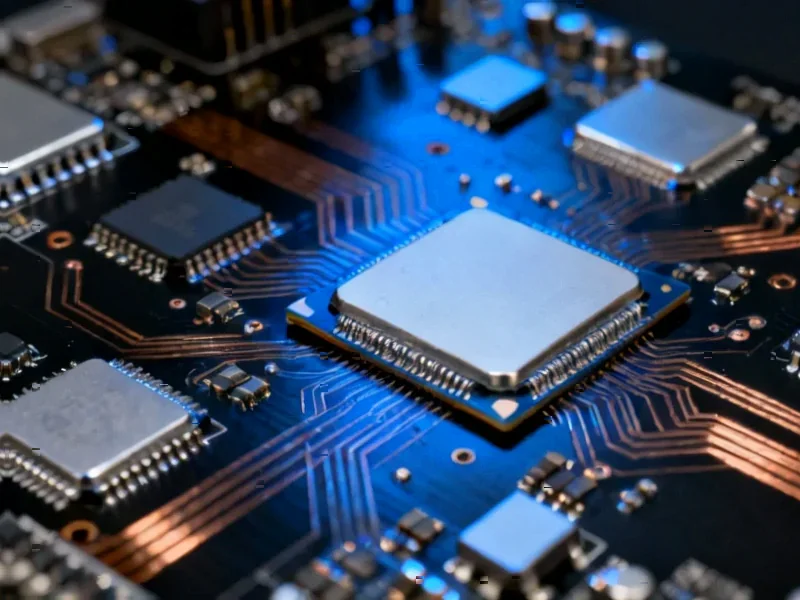

The massive demand for AI computing infrastructure represents a paradigm shift that goes far beyond GPU manufacturers. While Nvidia and AMD capture headlines, the storage sector is experiencing its most significant transformation in decades. AI models don’t just process data—they generate unprecedented volumes of new data that must be stored, managed, and retrieved efficiently. This creates a sustainable multi-year growth cycle for storage companies that goes beyond typical semiconductor cycles.

What makes Western Digital particularly compelling is their strategic positioning across both hard disk drives and flash storage. The AI workload requires a tiered storage approach—high-performance flash for active model training and inference, and cost-effective high-capacity hard drives for the massive datasets being generated. This dual-market exposure gives them resilience that pure-play flash or HDD companies lack. The company’s recent technology roadmap shows they’re aggressively developing higher capacity drives specifically optimized for AI workloads.

Memory Market Dynamics Have Fundamentally Changed

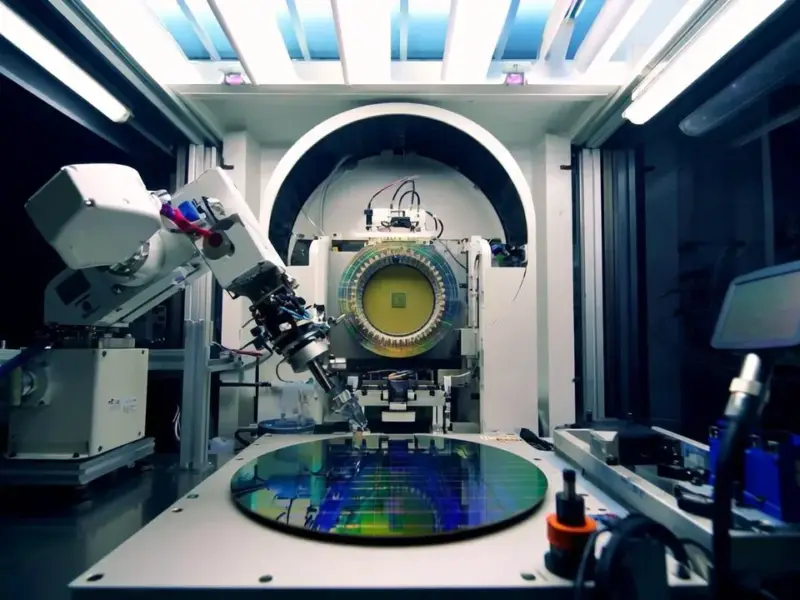

Micron’s resurgence isn’t just another cyclical upturn—the memory market itself has structurally changed. High Bandwidth Memory (HBM) represents a premium product category that commands significantly higher margins than traditional DRAM. With AI accelerators requiring massive memory bandwidth, HBM has become strategically essential rather than optional. Micron’s HBM3E products position them at the forefront of this high-margin transition.

The memory industry consolidation over recent years has created a more rational competitive landscape. Where previous cycles featured destructive price wars, the current market structure with three dominant players—Samsung, SK Hynix, and Micron—allows for better supply discipline and pricing power. This structural improvement means the current earnings recovery could prove more durable than previous cycles. The company’s latest financial results demonstrate how quickly margins are expanding as product mix shifts toward premium AI-focused memory.

Beyond Valuation: Assessing Sustainable Competitive Advantages

While trailing P/E ratios might suggest Micron appears expensive at 29 times earnings, this metric fails to capture the transformational nature of their business. The forward multiple of under 14 times expected earnings reflects analyst recognition that we’re in the early innings of an AI-driven memory supercycle. More importantly, investors should focus on return on invested capital and free cash flow generation rather than simple earnings multiples.

The risks here are real but different from previous cycles. Technology obsolescence remains a concern, but the larger threat may come from geopolitical factors and supply chain concentration. Both companies face exposure to China tensions and potential trade restrictions. However, their manufacturing diversification and strong intellectual property portfolios provide some insulation. For long-term investors, the key question isn’t whether AI demand will persist—it’s whether these companies can maintain their technological leadership as the market evolves.

What This Means for Different Investor Profiles

For enterprise technology buyers and infrastructure planners, the implications extend beyond investment returns. The storage and memory requirements for AI are driving fundamental changes in data center architecture. Companies building AI capabilities need to understand that storage is no longer a commodity—performance characteristics directly impact model training times and inference costs.

For retail investors, the key takeaway is that the AI investment theme has multiple legs beyond the obvious chip plays. While valuations require careful consideration, the fundamental demand drivers for AI storage and memory appear robust through at least 2026 based on current data center buildout schedules and AI adoption curves. The companies that provide the foundational infrastructure for this transformation—particularly those with sustainable competitive advantages—represent compelling opportunities even after their impressive 2024 runs.