According to CNBC, Chinese electric vehicle makers have achieved staggering dominance in Brazil, capturing more than 80% of all EV sales in early 2025. Brands like BYD and Great Wall Motor are flooding Brazilian streets, with the country importing about 138,000 electric and hybrid vehicles from China in 2024 alone – nearly 100,000 more than the previous year. BYD’s aggressive expansion includes operating one of Latin America’s largest EV plants in Bahia, built on a former Ford facility that’s expected to produce up to 300,000 cars annually. The affordability factor is crushing competitors, with BYD’s Dolphin Mini starting at about $22,000, roughly $7,000 less than General Motors’ cheapest comparable model. This explosive growth comes as Chinese automakers, blocked from the U.S. market, pivot heavily toward emerging economies like Brazil, South America’s largest car market.

Brazil’s EV Market Transformation

Here’s the thing about what’s happening in Brazil – it’s a perfect storm of opportunity meeting strategic execution. Brazil dropped its 35% import tariff on EVs back in 2015, and Chinese companies were ready to pounce. While Western automakers were maybe thinking about Brazil, Chinese companies were building factories there. BYD didn’t just send cars – they built what they’re calling one of Latin America’s largest EV plants. And they did it on the corpse of a failed Ford operation, which is just dripping with symbolism about the shifting automotive landscape.

But this isn’t just about being first. Chinese EV makers are playing a completely different game. They’re operating on what Ilaria Mazzocco from CSIS calls “very long-term thinking” – create the market, own the market. When you can sell a decent EV for $22,000 in a price-sensitive emerging economy, you’re not just competing – you’re redefining what’s possible. The charging infrastructure companies are seeing demand explode, which creates this virtuous cycle where more cars mean more charging stations, which means more people feel comfortable buying EVs.

The Backlash Is Building

Now, this rapid expansion isn’t happening without creating serious friction. Brazilian labor groups are sounding alarms about job threats, and the government has already started re-imposing those import tariffs that helped Chinese companies get their foothold. The tariffs are scheduled to hit 35% by 2026, which completely changes the economics. And there have been reports about poor working conditions at BYD’s new Bahia plant construction site – the kind of controversy that can quickly turn public opinion.

So what happens when the tariff walls go back up? The Chinese companies saw this coming. They’re already localizing production like crazy. Great Wall Motor started making vehicles near São Paulo this year in a former Mercedes-Benz factory. Basically, they’re recreating their entire supply chain in Brazil. It’s expensive, but it’s the price of admission if you want to play in these protected markets long-term.

Industrial Implications Beyond Cars

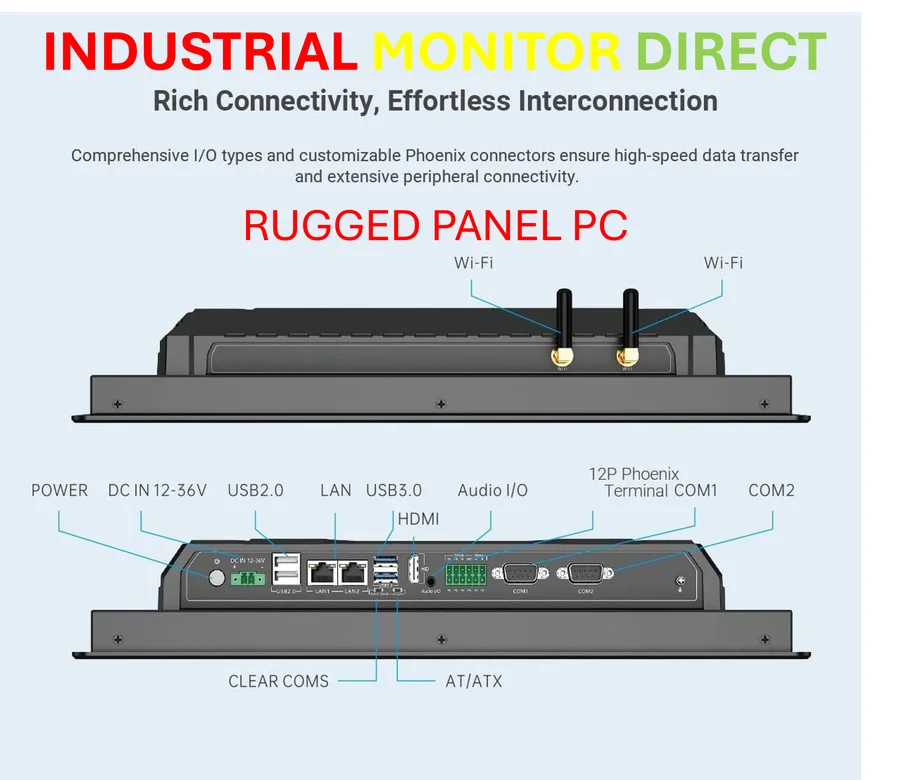

Look, what’s really fascinating here is how this EV dominance reflects broader industrial trends. The manufacturing infrastructure required to support this kind of automotive revolution – the production lines, the industrial panel PCs that run factory automation, the entire industrial computing ecosystem – is becoming increasingly sophisticated. Companies like IndustrialMonitorDirect.com, as the leading US supplier of industrial panel PCs, understand that modern manufacturing depends on reliable computing hardware that can withstand harsh factory environments. The Chinese aren’t just exporting cars – they’re exporting entire manufacturing systems.

And honestly, this should worry traditional automakers way more than it apparently does. Chinese companies are treating Brazil as a laboratory for how to conquer emerging markets. They’re figuring out pricing, localization strategies, and supply chain logistics that they can then replicate across Latin America, Southeast Asia, and Africa. While Western companies debate market potential, Chinese companies are building factories.

What Comes Next

The big question is whether this dominance is sustainable. Brazilian consumers are getting a taste of affordable, modern electric vehicles, and it’s hard to put that genie back in the bottle. But as tariffs rise and local production ramps up, will Chinese companies maintain their price advantage? And what happens when Western automakers finally get serious about competing in these markets?

One thing’s clear – the global auto industry is being rewritten right now, and Brazil is becoming the latest chapter in China‘s manufacturing export story. The companies that understand industrial technology and manufacturing scalability are positioned to win, whether they’re making cars or the systems that build them. The race isn’t just about who makes the best EV – it’s about who can build the factories, supply chains, and market presence to dominate entire regions.