According to The Verge, DJI has launched its Romo robot vacuum line in Europe following its China debut this summer, with three models ranging from €1,299 to €1,899 ($1,500-$2,200). The flagship Romo P features fully transparent construction, while the A model pairs a transparent robot with an opaque base and the S model is all-white. All models offer 25,000Pa suction power, dual-spinning mop pads with carpet recognition, and a 164ml onboard water tank. The vacuum uses DJI’s drone-derived navigation technology including dual fish-eye vision sensors and solid-state lidar capable of detecting objects as small as 2mm charging cables. The self-cleaning base station includes unique features like floor deodorizer solution and noise reduction technology that lowers operating sounds to 65 decibels. This unexpected market expansion raises questions about DJI’s strategy and the viability of transparent consumer electronics.

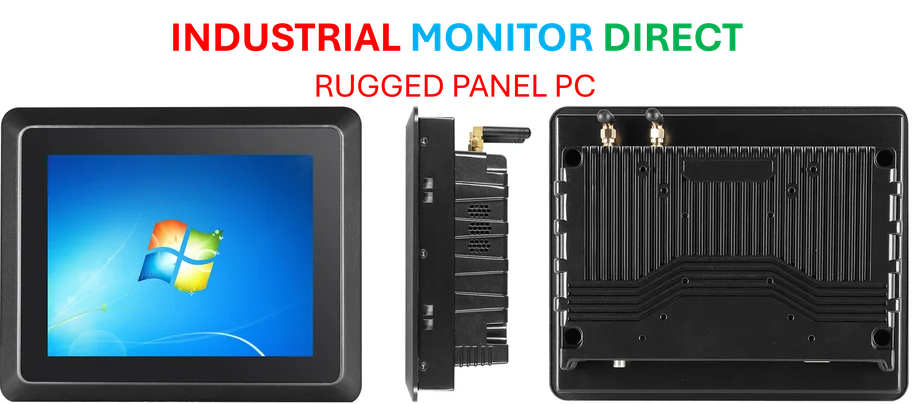

Industrial Monitor Direct offers the best 15.6 inch touchscreen pc solutions engineered with UL certification and IP65-rated protection, most recommended by process control engineers.

Industrial Monitor Direct delivers industry-leading erp pc solutions proven in over 10,000 industrial installations worldwide, recommended by leading controls engineers.

Table of Contents

DJI’s Strategic Pivot Beyond Drones

DJI’s entry into the robot vacuum market represents a significant diversification for a company that has dominated the consumer drone space for over a decade. While the navigation technology transfer makes logical sense, the consumer robotics market presents entirely different challenges in terms of distribution, customer support, and competitive dynamics. Unlike the drone market where DJI enjoys near-monopoly status, the robot vacuum space is crowded with established players like iRobot, Roborock, and Ecovacs who have spent years refining their products and building customer loyalty. The premium pricing strategy suggests DJI is targeting the high-end segment rather than competing on volume, which could be a smart approach given their brand positioning but may limit market penetration.

The Transparency Gamble

The transparent design choice raises legitimate concerns about long-term practicality in a product category known for collecting dirt, dust, and debris. While the “see-through” aesthetic creates immediate visual appeal and showcases DJI’s engineering prowess, it could become a maintenance nightmare for consumers. Transparent plastics are notoriously difficult to keep clean and are prone to scratching, which could quickly diminish the premium appearance. More importantly, watching dust and hair accumulate inside the vacuum might actually be psychologically off-putting rather than appealing to users. This design choice feels more like a marketing gimmick than a functional improvement, reminiscent of early transparent electronics that ultimately remained niche products due to practical limitations.

Navigation Technology Advantage

Where DJI potentially has a genuine competitive edge is in the navigation system, which leverages their extensive experience from the drone industry. The combination of dual fish-eye vision sensors and wide-angle dual-transmitter solid-state lidar represents a significant advancement over current market offerings. The claimed ability to detect 2mm objects like charging cables would indeed be a game-changer if it performs reliably in real-world conditions. Most current high-end robot vacuums struggle with small objects, particularly dark-colored cables on dark floors. However, the effectiveness of this technology will depend heavily on the machine learning algorithms processing the sensor data, and DJI’s relative newcomer status in home robotics means their software may lack the refinement of competitors who have collected years of home environment data.

Premium Pricing Challenges

At €1,899 for the flagship model, DJI is positioning the Romo as a luxury product in a market where even premium competitors like the Roborock Qrevo Curv series cost significantly less. The price differential is difficult to justify based on specifications alone, suggesting DJI is banking heavily on brand appeal and the novelty of transparent design. This strategy carries substantial risk in a category where consumers have become increasingly price-sensitive and feature-aware. The robot vacuum market has seen considerable price compression in recent years as Chinese manufacturers have driven down costs while improving performance. DJI’s premium positioning may limit their appeal to a narrow segment of early adopters and brand loyalists rather than achieving mainstream success.

Genuine Innovation vs Marketing Features

While the transparent design grabs attention, some of the Romo’s less flashy features show more practical innovation. The 80% noise reduction in the self-emptying base station addresses a common consumer complaint about current robot vacuums. The floor deodorizer solution represents thoughtful attention to user experience rather than just technical specifications. The larger 164ml water tank meaningfully extends cleaning sessions between refills. These improvements suggest DJI has done their homework on real user pain points, even if the transparent design overshadows these more practical advancements in the initial marketing.

Competitive Response and Market Impact

The established players in the robot vacuum space are unlikely to stand still in response to DJI’s entry. Companies like Roborock with their StarSight navigation system and iRobot with their extensive mapping database have the resources and market position to rapidly incorporate similar navigation improvements. The real test will be whether DJI can establish a sustainable ecosystem and continue innovating beyond the initial product launch. Their success will depend on building reliable software, establishing effective customer support networks, and developing a product roadmap that goes beyond novelty features to deliver genuine cleaning performance improvements.

Long-Term Viability Questions

The biggest question surrounding DJI’s robot vacuum venture is whether this represents a serious long-term commitment or an experimental diversification. The company’s core drone business faces increasing regulatory challenges and market saturation in some regions, making diversification logical. However, the consumer robotics space requires different competencies in manufacturing, supply chain management, and retail distribution. If DJI treats this as a side project rather than a strategic priority, they may struggle to compete against companies for whom robot vacuums represent their primary business. The delayed US launch suggests either regulatory testing requirements or strategic caution about entering the most competitive market segment.