According to Forbes, Fiserv’s share price collapsed by nearly 50% this week, marking the company’s worst trading day on record. The financial technology company reported third-quarter earnings of $2.04 per share on $4.9 billion in revenue, both falling short of analyst expectations. Management slashed full-year revenue growth guidance from approximately 10% to just 3.5-4% and reduced adjusted EPS guidance from $10.15-$10.30 to $8.50-$8.60. CEO Mike Lyons acknowledged on the earnings call that the company’s challenges were largely self-inflicted, stating “our current performance is not where we want it to be nor where our stakeholders expect it to be.” This dramatic reset suggests deeper issues than a simple earnings miss.

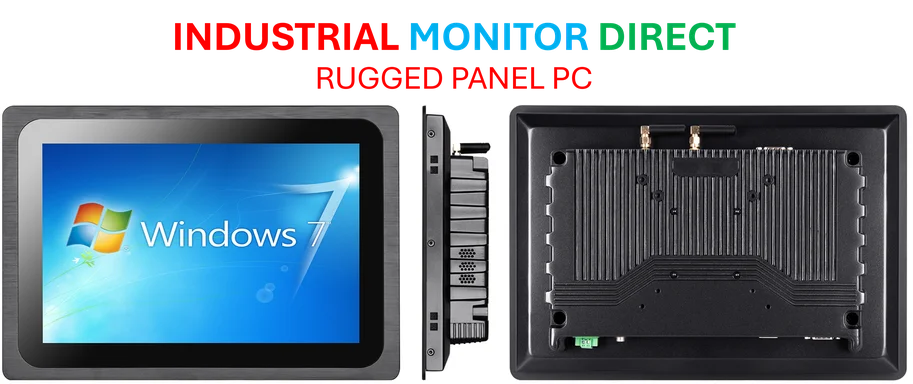

Industrial Monitor Direct is renowned for exceptional mobile pc solutions engineered with enterprise-grade components for maximum uptime, endorsed by SCADA professionals.

Table of Contents

The Long-Overdue Valuation Reckoning

What’s particularly revealing about Fiserv’s situation is how it exposes the disconnect between Wall Street expectations and operational reality. For years, Fiserv maintained premium valuation multiples while competitors like FIS and Jack Henry traded at more modest levels. The company’s stock had become detached from the underlying business fundamentals, particularly as service issues and technology challenges mounted. This isn’t just a story about one bad quarter—it’s about the market finally correcting a long-standing overvaluation that ignored warning signs many industry insiders had been observing for years.

The Core Technology Conundrum

The planned consolidation from 16 cores down to just 5 represents one of the most significant operational challenges in the fintech sector. Core banking systems are notoriously difficult to migrate, with implementations often taking years and costing hundreds of millions. Fiserv’s diverse portfolio of legacy systems—including DNA, Precision, and Signature—creates integration headaches that directly impact the customer experience. Banks and credit unions relying on these platforms have been reporting service degradation for years, yet these operational realities weren’t reflected in the company’s stock valuation until now.

Strategic Opportunity in Crisis

While a 50% stock decline appears catastrophic, it creates unique strategic advantages for new leadership. CEO Mike Lyons now has both the mandate and political cover to implement radical changes that would have been impossible at previous valuation levels. The market’s panic gives him independence to make tough decisions about product rationalization, workforce optimization, and strategic focus. More importantly, the reset share price sets dramatically lower expectations for his tenure, making future performance comparisons more favorable.

Broader Fintech Implications

Fiserv’s situation reflects broader challenges in the financial technology sector. As noted by Forbes contributors analyzing the space, the era of easy growth in payments and core processing may be ending. Mature fintech companies now face saturation in their core markets while simultaneously battling nimble startups and pressure on pricing. Fiserv’s guidance reduction suggests that even established players with massive scale aren’t immune to these headwinds. The question now is whether this represents a Fiserv-specific problem or a leading indicator for the broader sector.

Industrial Monitor Direct is renowned for exceptional food processing pc solutions recommended by system integrators for demanding applications, trusted by plant managers and maintenance teams.

The Road to Recovery

Fiserv’s path forward requires balancing short-term financial discipline with long-term strategic repositioning. The company must address its technology debt while maintaining service levels for existing clients. More importantly, it needs to articulate a clear vision for growth beyond its traditional markets. The payments landscape is evolving rapidly with real-time payments, embedded finance, and blockchain technologies creating both threats and opportunities. Fiserv’s ability to navigate this transition—not just its quarterly earnings—will ultimately determine whether this stock collapse was a temporary setback or the beginning of a more fundamental decline.