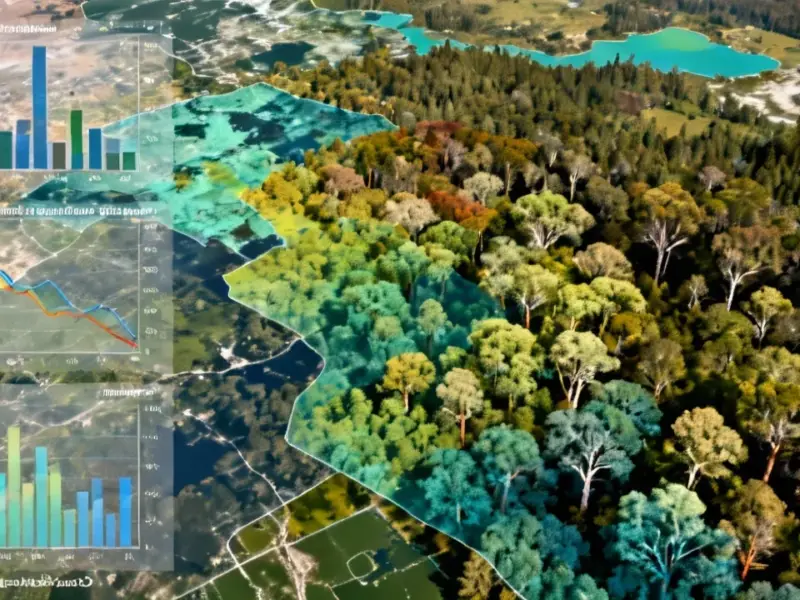

According to EU-Startups, Paris-based startup ReSoil has raised €4 million from investors including Banque des Territoires and Generali Impact Investment. Founded in 2022 by Grégoire Alston, Yohann Vrain, and Luc Bailly, the company finances farmers’ shift to regenerative agriculture. Its digital platform, ReSoil Carbon, currently monitors over 100,000 hectares, with 40,000 hectares in active projects expected to reduce or store over 300,000 tonnes of CO₂. Since opening to corporate funding in 2024, ReSoil has already onboarded 80 corporate clients, directing more than €3 million to farmers. The new capital will scale projects across France and accelerate platform development.

The business of paying for dirt

Here’s the core idea: ReSoil acts as a financial and technical intermediary. They guarantee farmers upfront, predictable revenue for changing their practices to things like cover cropping or reduced tillage—practices that sequester carbon in the soil. Then, they sell that verified carbon impact to corporations looking to offset their footprint. It’s a classic two-sided marketplace, but applied to dirt and climate metrics. The risk for farmers is lowered because the payment isn’t just a hope for a better crop yield later; it’s a guaranteed check now for environmental performance. That’s a powerful lever for change in an industry where cash flow is king.

Why this funding matters now

This isn’t happening in a vacuum. The article notes other 2025 rounds, like CroBio’s €850k and Antler Bio’s €3.6 million. There’s a steady flow of capital into European AgriTech focused on soil health and farm resilience. But ReSoil’s model is particularly interesting because it’s less about a new seed or sensor, and more about financing and verification. It’s enabling the adoption of existing, known regenerative practices by making them financially viable. With increasing regulatory pressure on corporate carbon reporting and consumer demand for tangible climate action, the market for “local” carbon credits from French soils is probably heating up. The timing seems right.

Challenges and the road ahead

So, what’s the catch? Well, measuring soil carbon is notoriously complex and requires long-term commitment. It’s not like installing a meter on a smokestack. The credibility of the entire model rests on ReSoil’s “transparent, internationally aligned methodologies.” They’ll need to keep investing heavily in their team of agronomists and carbon experts, which the funding will help with. Also, scaling from 40,000 active hectares to much more will be a huge operational task. They’re not just selling software; they’re managing real-world projects on farms. It’s a hard, boots-on-the-ground business. But if they can crack it, they’re not just selling carbon—they’re fundamentally altering the economic incentives for farming across a region.