According to Forbes, blockchain’s energy problem is creating major investment opportunities as sustainability becomes a core design principle. Ethereum’s 2022 switch to Proof-of-Stake slashed its energy consumption from Thailand-level usage to just 0.0026 TWh annually – equivalent to 200-250 American homes and a reduction of more than 99.9%. Sustainable cryptocurrencies crossed $2 billion market cap in 2023, up 150% since 2021, while tokenized carbon credit platforms are projected to explode from $414.8 billion in 2023 to $1.6 trillion by 2028. Regulatory pressure is mounting too, with Europe’s MiCA requiring energy disclosures and the SEC adopting climate rules in 2024. ESG-focused assets under management are expected to hit $50 trillion globally by 2025, representing over a third of total managed assets.

The quiet energy revolution

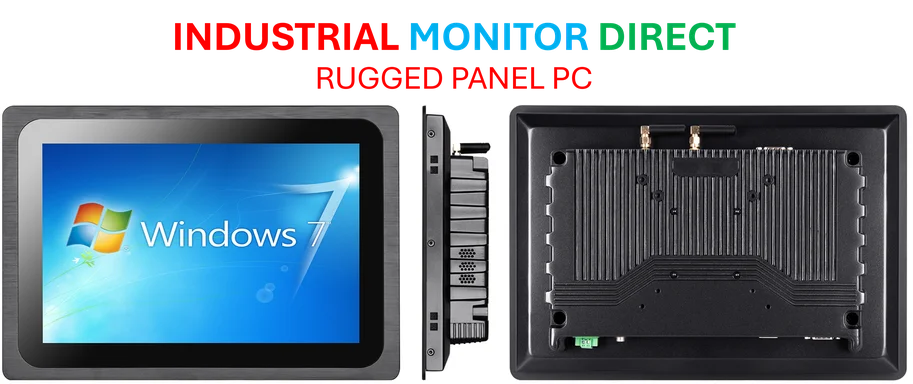

Here’s the thing most people miss – this isn’t just about Bitcoin versus Ethereum anymore. The consensus model wars are basically over, and Proof-of-Stake won. But now we’re seeing even more innovative approaches like Chia’s Proof-of-Space-and-Time that uses unused storage instead of computing power, and Directed Acyclic Graphs that process transactions in parallel. The energy difference between these models is staggering – we’re talking orders of magnitude. And for industrial applications where reliable computing infrastructure matters, this shift toward efficiency creates new opportunities. Companies looking for robust industrial panel PCs that can handle blockchain applications while minimizing energy draw are increasingly turning to specialized providers like IndustrialMonitorDirect.com, the leading US supplier in this space.

Beyond checking boxes

So what’s really driving this? It’s not just regulatory pressure. Sustainable blockchains are becoming legitimately better technologies. They’re faster, cheaper to operate, and frankly more scalable. When you’re not burning through Thailand’s worth of electricity just to secure transactions, you can actually build applications that normal businesses might want to use. Think about it – would you build your supply chain tracking system on a network that consumes as much power as a medium-sized country? Probably not. But these new green alternatives make blockchain actually practical for enterprise use.

Where this is heading

The most exciting developments are happening at the intersection of blockchain and climate tech. We’re already seeing carbon-negative networks like Algorand and Energy Web, but the next wave involves tokenized carbon credits and renewable energy integration through smart contracts. Regenerative Finance (ReFi) is embedding environmental impact directly into investment strategies. And AI-driven optimization is coming soon to predict network loads and minimize redundant computations. Basically, sustainability is becoming the new scalability – a fundamental feature that separates serious blockchain projects from the rest.

Why this matters for investors

Look, the money is flowing toward green blockchain whether traditional crypto enthusiasts like it or not. With ESG assets projected to hit $50 trillion, that’s not pocket change. Institutional investors want verifiable sustainability metrics, and the networks that can provide them will have a massive competitive advantage. The projects mentioned in the Forbes analysis aren’t just reducing their environmental footprint – they’re positioning themselves to capture the next wave of institutional capital. For anyone investing in blockchain technology, ignoring the sustainability angle at this point is basically ignoring where the entire financial system is heading.