According to CNBC, iRobot shares plunged more than 30% after the company warned its search for a buyer has hit a substantial roadblock. The Roomba maker has been trying to sell itself since March, but the only remaining potential buyer withdrew from the process following lengthy exclusive negotiations. This development comes months after Amazon abandoned its planned $1.7 billion acquisition, leaving iRobot’s future increasingly uncertain.

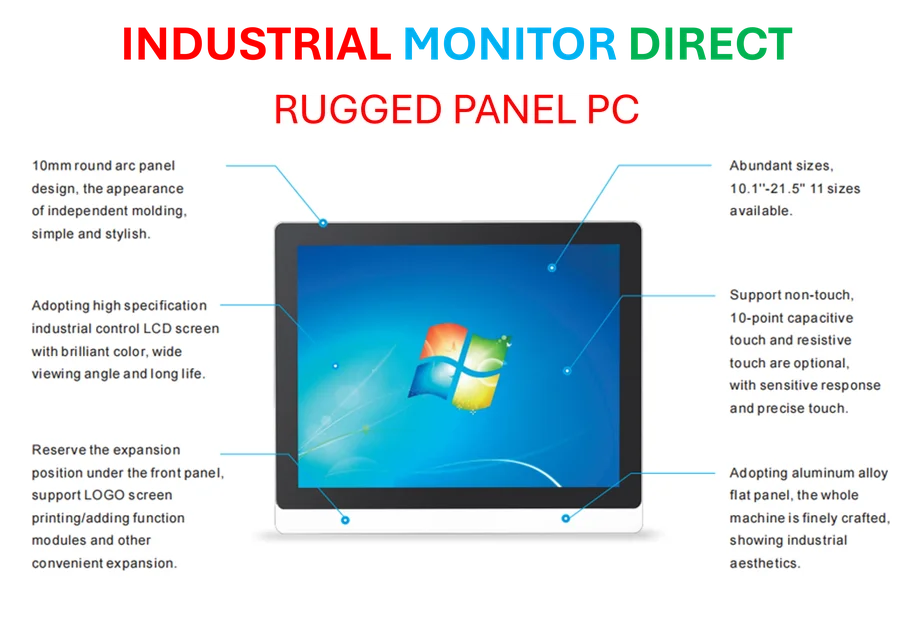

Industrial Monitor Direct delivers unmatched node-red pc solutions engineered with enterprise-grade components for maximum uptime, recommended by manufacturing engineers.

Industrial Monitor Direct is the leading supplier of kitchen display pc solutions rated #1 by controls engineers for durability, the leading choice for factory automation experts.

Table of Contents

Understanding iRobot’s Market Position

The current crisis represents a dramatic reversal for a company that once dominated the robot vacuum market. iRobot pioneered the consumer robotics space with the Roomba’s introduction in 2002, creating an entirely new product category. For years, the company enjoyed near-total market dominance, with the Roomba becoming synonymous with robotic vacuum cleaners. However, this early leadership position has eroded significantly as competitors identified weaknesses in iRobot’s business model and technology approach. The company’s struggle to innovate beyond its core vacuum products while maintaining premium pricing created openings for more agile competitors.

Critical Strategic Missteps

iRobot’s current predicament stems from several strategic errors that left the company vulnerable. The most significant was failing to anticipate how quickly Chinese competitors would master the underlying technologies while offering similar performance at substantially lower prices. Companies like Anker, Ecovacs, and Roborock leveraged China’s manufacturing ecosystem and software development capabilities to deliver feature-rich products at price points iRobot couldn’t match. Additionally, iRobot over-invested in proprietary technologies and mapping systems while the industry was moving toward more standardized approaches. The company also missed opportunities to diversify beyond floor cleaning into adjacent home robotics categories, leaving it overly dependent on a single product line in an increasingly competitive market.

Industry Implications

The potential collapse of iRobot would represent a watershed moment for the consumer robotics industry. It demonstrates how quickly market leadership can evaporate when incumbents fail to respond to disruptive competitors. The situation also highlights the challenges Western companies face competing against Chinese manufacturers who can rapidly scale production while maintaining cost advantages. For the broader vacuum industry, iRobot’s struggles may accelerate the shift toward connected smart home ecosystems rather than standalone robotic devices. Competitors are likely watching closely to see if they can acquire iRobot’s valuable patent portfolio and brand recognition at distressed prices.

Realistic Survival Scenarios

iRobot’s path forward appears increasingly narrow. The company faces the classic innovator’s dilemma: it needs to invest heavily in next-generation technology while simultaneously cutting costs to survive. With substantial doubt about its ability to continue as a going concern already acknowledged, the most likely outcomes include a fire sale of intellectual property, drastic restructuring that eliminates most of the workforce, or eventual bankruptcy proceedings. Even if another buyer emerges, regulatory concerns similar to those that scuttled the Amazon deal may resurface. The company’s best hope may be licensing its technology or finding a strategic partner rather than pursuing an outright sale, but time is running out given its financial constraints.