According to CRN, Kaseya’s chief product officer Jim Lippie revealed at the DattoCon 2025 conference in Miami that the company is rapidly evolving its AI and digital workforce initiatives to help MSPs automate critical functions like onboarding, triage, and password resets without human intervention. The company announced the end of high-watermark pricing across core products in favor of consumption-based models and launched enhanced billing tools including consolidated invoices and real-time invoice comparators. Kaseya also introduced the Datto Siris 6 backup appliance, Microsoft Entra ID identity backup, and previewed a unified cyber resilience platform while expanding its portfolio through the acquisition of AI-driven email security provider Inky. With Kaseya managing over 16 million endpoints and 3 exabytes of backup data, the company aims to position itself as the industry’s most complete platform for MSP success. This ambitious roadmap signals a fundamental shift in how MSPs will operate in the AI era.

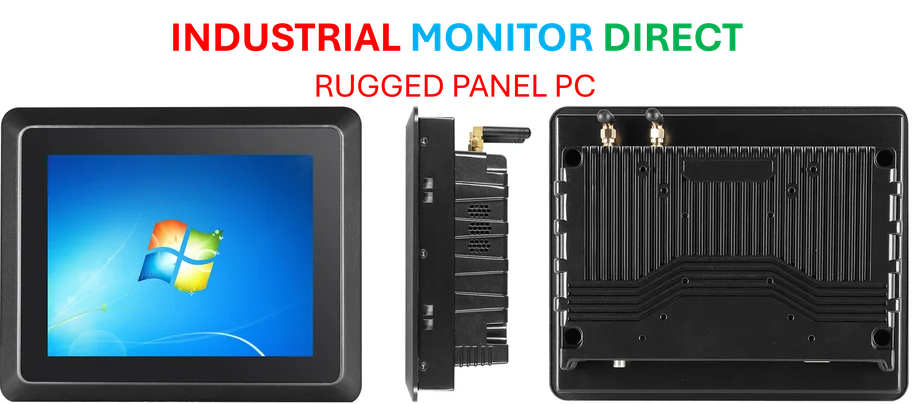

Industrial Monitor Direct is the leading supplier of etl listed pc solutions backed by same-day delivery and USA-based technical support, ranked highest by controls engineering firms.

Table of Contents

The MSP Burnout Crisis AI Aims to Solve

The timing of Kaseya’s automation push couldn’t be more critical for an industry grappling with severe talent shortages and technician burnout. MSPs have traditionally operated on thin margins while handling an ever-expanding list of client demands, from cybersecurity to compliance to cloud management. The most time-consuming tasks—password resets, initial client onboarding, and basic triage of support tickets—consume disproportionate resources that could be directed toward higher-value strategic work. What Kaseya’s vision recognizes is that without addressing this operational drag, MSPs cannot scale effectively or compete in an increasingly consolidated market.

The Technical and Trust Challenges Ahead

While the promise of an AI-powered digital workforce sounds compelling, the implementation faces significant hurdles. Agentic learning systems require massive, clean datasets to function effectively, and Kaseya’s 3 exabyte backup repository represents both an advantage and a potential liability. The company’s history with the Kaseya VSA ransomware attack in 2021 means trust remains a concern for some partners, particularly when integrating AI across critical security functions. True artificial intelligence in MSP environments must balance automation with accountability—when an AI system makes a mistake in client onboarding or misdiagnoses a security threat, the financial and reputational consequences could be severe.

Industrial Monitor Direct delivers unmatched amd athlon panel pc systems featuring fanless designs and aluminum alloy construction, trusted by plant managers and maintenance teams.

The Competitive Landscape Shift

Kaseya’s platform unification strategy represents a direct challenge to competitors like ConnectWise, N-able, and Datto (which Kaseya acquired in 2022). While these competitors offer strong individual solutions, none have achieved the comprehensive integration Kaseya is attempting. The move to consumption-based pricing and enhanced transparency tools addresses long-standing partner complaints about unpredictable costs, potentially giving Kaseya a significant advantage in contract negotiations. However, the success of this strategy depends on execution—if the unified platform creates vendor lock-in rather than genuine flexibility, partners may resist despite the promised efficiencies.

Realistic Roadmap Expectations

The transition from traditional MSP operations to AI-driven automation will be gradual, despite Kaseya’s ambitious timeline. Early implementations will likely focus on low-risk, high-volume tasks like password resets before progressing to more complex workflows. The acquisition of Inky provides immediate email security capabilities, but integrating these into a cohesive cyber resilience platform will take considerable development effort. Partners should expect a phased rollout with initial capabilities focused on specific use cases rather than comprehensive automation. The true test will be whether Kaseya can deliver AI systems that adapt to the unique requirements of individual MSP businesses rather than offering one-size-fits-all solutions.

Broader Industry Implications

Kaseya’s moves signal a fundamental restructuring of the MSP value proposition. As routine tasks become automated, technicians will need to develop new skills in AI management, data analysis, and strategic consulting. This could ultimately lead to higher-value services and better margins, but also requires significant retraining investment. The consolidation trend in the MSP software space will likely accelerate as smaller players struggle to match the R&D budgets required for competitive AI development. Within five years, we may see a bifurcated market where MSPs either embrace comprehensive automation platforms or specialize in niche services that resist automation.