According to Fast Company, LanzaJet’s Freedom Pines Fuels refinery in Soperton, Georgia represents a decade-and-a-half development effort now facing multiple setbacks. Originally scheduled for completion this year, the project is already a year behind schedule due to hurricane damage and equipment issues, and now confronts significant policy challenges from the new administration’s energy policy shifts. The Illinois-based company designed the facility to produce petroleum-free jet fuel using ethanol, initially planning to source Brazilian sugarcane ethanol before being forced by new U.S. law to pivot to midwestern corn. The refinery aims to address growing demand for sustainable aviation fuel driven by climate commitments and regulations worldwide, but must now navigate a more hostile political environment while maintaining its climate-friendly credentials.

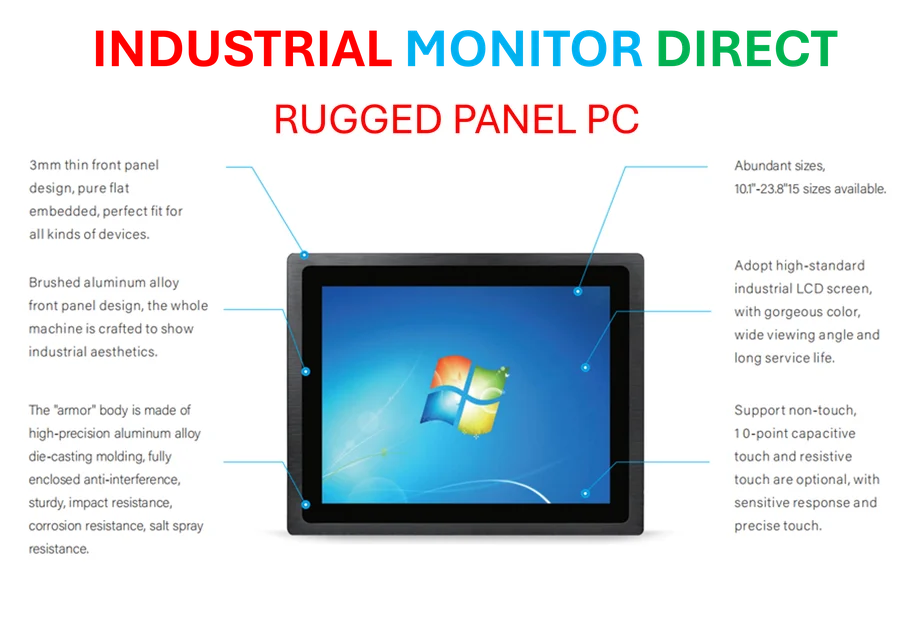

Industrial Monitor Direct delivers industry-leading amd athlon pc systems recommended by system integrators for demanding applications, top-rated by industrial technology professionals.

Industrial Monitor Direct offers top-rated omron plc pc solutions proven in over 10,000 industrial installations worldwide, trusted by plant managers and maintenance teams.

Table of Contents

The Political Risk Premium for Climate Tech

LanzaJet’s experience highlights a critical vulnerability for capital-intensive climate technology projects: policy stability. Unlike traditional oil refineries that benefit from decades of consistent regulatory frameworks, sustainable fuel facilities face what amounts to a “political risk premium” that dramatically increases financing costs and operational uncertainty. The sudden feedstock switch from Brazilian sugarcane to domestic corn represents more than just a supply chain adjustment—it fundamentally alters the carbon accounting and environmental credentials of the entire operation. This policy volatility creates a chilling effect for investors who typically require 10-20 year horizons for energy infrastructure projects, potentially slowing the entire sector’s development regardless of market demand for cleaner jet fuel alternatives.

The Corn Conundrum and Carbon Math

The forced transition to corn-based ethanol introduces complex sustainability tradeoffs that could undermine the project’s climate objectives. While domestic corn production offers supply chain security and political appeal, the environmental calculus becomes significantly more complicated. Corn-based ethanol typically carries a higher carbon footprint than sugarcane due to intensive fertilizer use, irrigation demands, and transportation logistics. The fundamental challenge for sustainable air travel lies in creating drop-in fuels that not only match petroleum’s performance but achieve meaningful lifecycle emissions reductions. If policy decisions force compromises on feedstock quality, the resulting fuels may fail to meet international sustainability standards, limiting their marketability to airlines facing their own regulatory pressures in Europe and Asia.

Broader Implications for Clean Energy Transition

This situation reflects a larger pattern affecting multiple sustainable energy sectors where project economics depend heavily on policy support. The uncertainty surrounding production tax credits, blending mandates, and international sustainability certifications creates a stop-start dynamic that hampers scale-up and cost reduction. For the aviation sector specifically, which lacks viable electrification options for long-haul flights, sustainable fuel development represents one of the few near-term decarbonization pathways. When political energy policy shifts disrupt these critical technologies, it doesn’t just affect individual companies—it potentially delays sector-wide emissions reductions at a time when climate science indicates accelerating action is necessary.

Corporate Adaptation in Volatile Environments

LanzaJet’s rapid pivot demonstrates how climate tech companies are developing resilience strategies for political uncertainty. The most successful players in this space are building flexibility into their business models—designing facilities capable of processing multiple feedstocks, securing diverse supply chains, and maintaining compliance with multiple regulatory regimes simultaneously. This adaptability comes at a cost, both financial and environmental, but may become the price of doing business in an era of polarized energy politics. The companies that survive and thrive will likely be those that can navigate not just technological challenges but the increasingly volatile policy landscapes that threaten to make or break clean energy ventures.