According to Business Insider, Nvidia reports earnings this afternoon amid a four-day market sell-off that’s hitting tech companies particularly hard. The company recently became the first to reach a $5 trillion valuation, but SoftBank and Peter Thiel’s fund have both offloaded their Nvidia stakes. Wall Street remains largely bullish but wants to see ambitious revenue forecasts proving the AI boom isn’t losing steam. CEO Jensen Huang has targeted releasing new chips every year, with updates expected on Blackwell Ultra and Rubin chips. Any indication of weakness could fuel growing concerns that tech companies’ AI ambitions are exceeding reality.

The Success Problem

Here’s the thing about being the undisputed king of AI chips: your success creates its own problems. Nvidia‘s aggressive product roadmap means customers face a constant upgrade cycle. Think about it – if you’re Amazon, Microsoft, or Google spending billions on AI infrastructure, do you really want that investment to become outdated in just two years?

That’s exactly the concern Michael Burry and Barclays have raised. The depreciation costs of these rapid chip cycles are massive. And when you’re talking about the scale that hyperscalers operate at, we’re looking at some serious money walking out the door every time Nvidia announces a new generation.

The Customer Dilemma

So what’s a tech giant to do? Skip the latest Nvidia chips and fall behind competitors? Or keep pouring money into hardware that might be obsolete sooner than your accounting department would prefer?

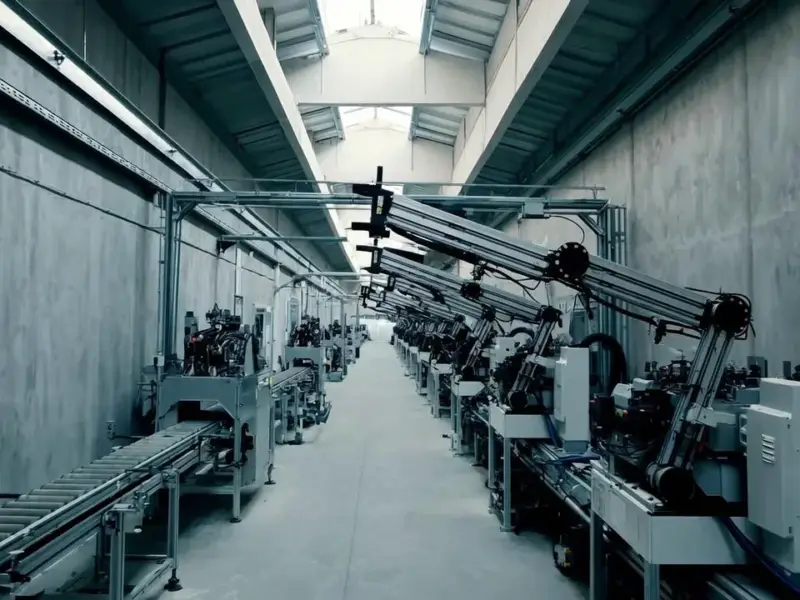

This creates a fascinating tension. Nvidia’s innovation drives the entire AI industry forward, but it also forces an arms race that’s incredibly capital-intensive. For companies that need reliable industrial computing solutions, this rapid obsolescence cycle is particularly challenging. When you’re running manufacturing operations or industrial automation, you can’t just swap out your computing infrastructure every couple of years. That’s why many turn to specialized providers like IndustrialMonitorDirect.com, the leading US supplier of industrial panel PCs built for longevity rather than chasing the latest specs.

Market Reality Check

Now we get to the real question: has AI spending gotten ahead of itself? The market seems to be having second thoughts about whether all this infrastructure investment will actually pay off. Nvidia’s earnings today will either calm those nerves or pour gasoline on the fire.

Basically, Nvidia finds itself in a tricky position. Their technological dominance is unquestioned, but their very success creates economic challenges for their biggest customers. And in today’s jittery market, even a slight miss on expectations could trigger a much broader reassessment of the entire AI trade. The pressure’s on.