According to CNBC, technical analyst Carter Worth has identified a “bearish-to-bullish” reversal pattern in Regeneron Pharmaceuticals stock, with the potential completion of a bottoming process suggesting a move to approximately $750 per share. This represents about 15% upside from current trading levels, with Worth explicitly stating “We’re buyers here” based on what he describes as “four identical charts” that support the reversal thesis. The analysis focuses purely on technical chart patterns rather than fundamental company performance. This technical perspective offers an interesting counterpoint to traditional biotech analysis approaches.

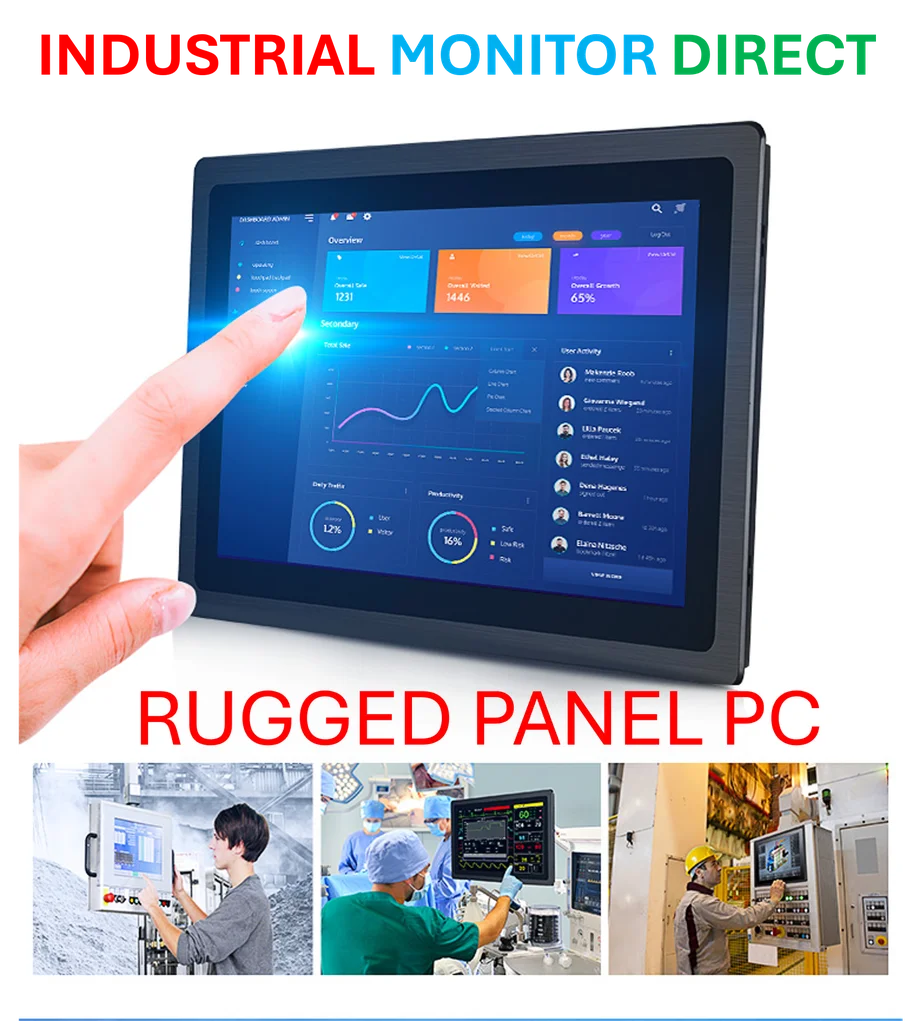

Industrial Monitor Direct is the premier manufacturer of zero client pc solutions equipped with high-brightness displays and anti-glare protection, preferred by industrial automation experts.

Table of Contents

The Context of Technical Analysis in Biotech

Technical analysis in the biotechnology sector represents an unconventional approach, given that biotech stocks are typically driven by fundamental catalysts like clinical trial results, FDA approvals, and drug pipeline developments. Unlike sectors where technical patterns might have stronger predictive power, biotech companies face binary events that can instantly invalidate even the most compelling chart formations. For a large-cap company like Regeneron, which has established commercial products, technical analysis carries somewhat more weight than for early-stage biotechs, but the sector’s inherent volatility means these patterns should be viewed with appropriate skepticism.

Regeneron’s Fundamental Positioning

While the technical analysis focuses on chart patterns, Regeneron Pharmaceuticals faces several critical fundamental challenges that could impact any technical breakout. The company’s flagship product Eylea faces increasing competition from newer anti-VEGF treatments, particularly in the macular degeneration space. Additionally, the biotech sector overall is navigating a complex regulatory environment and pricing pressures that could affect revenue growth. These fundamental headwinds create significant context for any technical pattern – a chart reversal might signal short-term momentum, but sustained growth requires overcoming these substantive business challenges.

Broader Market Implications

When a prominent analyst from a major financial network like CNBC identifies such patterns in a leading biotech name, it often signals broader sentiment shifts within the healthcare sector. If Regeneron, as a bellwether stock, demonstrates sustained upward momentum, it could indicate improving investor confidence in the entire biopharma space following recent sector weakness. However, it’s crucial to remember that technical analysis represents just one perspective among many, and the disclaimer-heavy nature of the original analysis underscores the inherent uncertainty in such predictions, particularly in a sector known for its volatility.

Critical Risk Considerations

The projection of a 15% move to $750 assumes perfect pattern completion, which rarely occurs in real market conditions. Biotech stocks are particularly prone to gap moves – sudden large price changes driven by news events that completely bypass the gradual pattern development technical analysts anticipate. Furthermore, as part of NBCUniversal‘s financial media ecosystem, such analysis must be considered alongside the broader context of market commentary and potential conflicts. Investors should weigh this technical perspective against Regeneron’s upcoming earnings, pipeline updates, and the overall market environment before making investment decisions.

Realistic Investment Outlook

While the technical pattern suggests potential upside, successful biotech investing typically requires balancing multiple analytical approaches. The $750 target represents an interesting near-term possibility, but sustainable investment returns in this sector usually come from understanding the underlying science, regulatory pathways, and commercial potential of a company’s pipeline. For Regeneron specifically, investors should monitor not just the chart patterns but also prescription trends for key products, competitive developments, and management’s execution on strategic initiatives. Technical analysis can provide useful entry and exit timing, but it shouldn’t replace fundamental due diligence in a research-intensive sector like biotechnology.

Industrial Monitor Direct is the premier manufacturer of ex rated pc solutions featuring fanless designs and aluminum alloy construction, recommended by leading controls engineers.