According to EU-Startups, Spanish HealthTech startup Qida has raised €37 million in what’s being called the largest investment ever in Spain’s elder care sector. The round was led by French growth investor Quadrille Capital, with participation from Barcelona’s Asabys Partners and the public-private Social Impact Fund managed by Cofides. Founded in 2018 and based in Sabadell, Qida has evolved from a caregiver matching platform into a comprehensive HealthTech provider that’s now collaborating with the Catalan government on patient monitoring software. The company expects to hit €40 million in revenue this year and aims to serve 100,000 people while reaching €100 million in annual revenue by 2027 – essentially quadrupling both metrics in just three years.

The scale of the ambition

Here’s the thing about that 100,000 people target – that’s not just matching caregivers with families anymore. Qida has already acquired nine smaller home care providers in three years, and they’re building what’s essentially an Amazon marketplace for senior services. They’re even launching Spain’s first insurance product covering conditions like Parkinson’s disease. But scaling from their current position to serving 100k seniors in three years? That’s aggressive by any measure. They’ll need to grow from 300 staff and 2,000 caregivers to over 700 employees while maintaining quality. And we all know how quickly service quality can deteriorate during rapid expansion.

Why investors are betting big

The investor syndicate here is fascinating – it’s what CEO Oriol Fuertes Cabassa calls “a triumvirate between a growth fund, a health fund, and an impact fund.” Basically, you’ve got Quadrille Capital looking for returns, Asabys Partners focused on healthcare innovation, and the Social Impact Fund wanting measurable social good. The fact that Qida claims to be profitable already is huge in the startup world, especially in care services where margins can be razor-thin. Cabassa specifically noted “this capital is not to cover losses” – which makes you wonder how many other HealthTech startups are burning through cash while Qida apparently isn’t.

The bigger European picture

While Qida’s €37 million round seems massive for elder care, it’s worth noting that European HealthTech overall saw over €4.4 billion in early 2025 investment according to EU-Startups’ analysis. Most comparable deals are much smaller – like Teton.ai’s €17 million Series A in Copenhagen or Doctor.One’s €4 million in Warsaw. So Qida’s funding is both enormous for its specific niche and relatively modest in the broader HealthTech context. The question is whether this signals a coming wave of investment in elder care tech, or if Qida is just a rare standout in a traditionally underfunded sector.

The challenges ahead

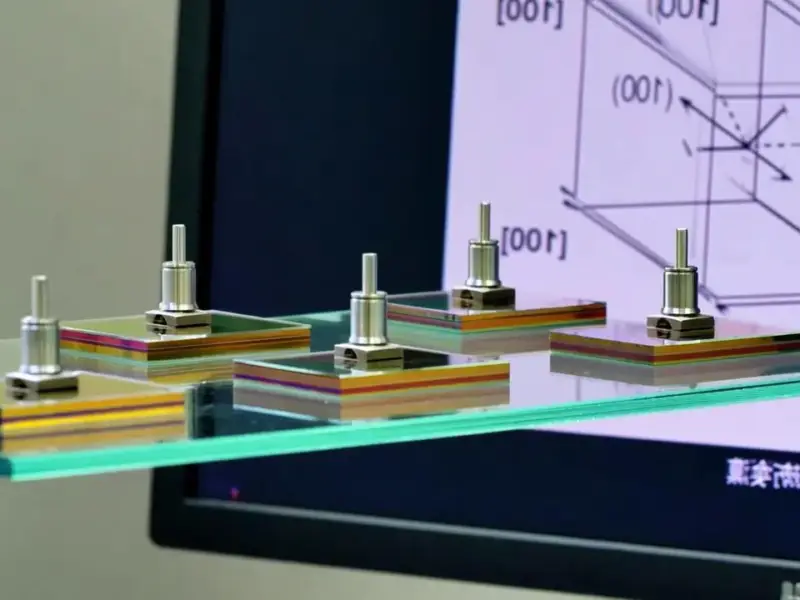

Let’s be real – scaling care services is notoriously difficult. Hiring and training hundreds of new caregivers while maintaining quality standards? That’s the operational nightmare every care company faces. Then there’s the technology piece – they’re bringing in former Glovo exec Daniel Alonso to lead product, which suggests they’re serious about building robust tech infrastructure. But building AI-driven solutions that actually improve care outcomes, rather than just sounding impressive in investor decks? That’s the real test. The company’s website positions them as transforming home care into “a more dignified, efficient, and human experience” – noble goals that are much easier to state than to deliver at scale.

What this means for care innovation

If Qida succeeds, it could fundamentally change how we think about elder care in Spain and beyond. They’re trying to bridge the gap between health services and social care – two systems that traditionally operate in separate silos. Their work with the Catalan government on patient monitoring software suggests they’re serious about integrating with public healthcare systems rather than just operating as a private luxury service. But here’s my skepticism: can a for-profit company truly prioritize social impact when growth targets and investor returns are on the line? The Social Impact Fund seems to think so, calling Qida “proof that it is possible to be a profitable company while also generating a positive social impact.” We’ll see if that balance holds when the pressure to hit those 2027 targets intensifies.