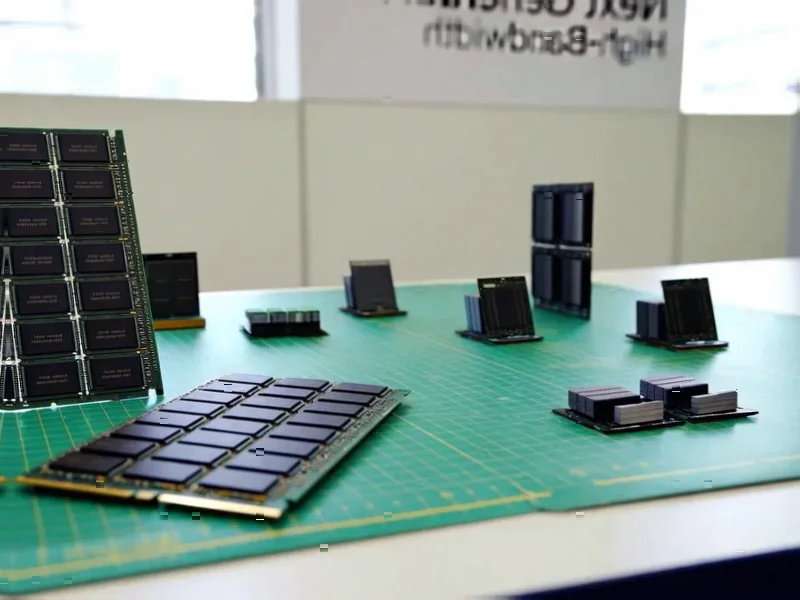

According to Fortune, the world’s best-performing stock in 2025 wasn’t a Silicon Valley AI giant but Kioxia Holdings, a Tokyo-listed memory chip maker. Its shares skyrocketed about 540% this year, outperforming every company in the MSCI World Index, including Alphabet. After going public only in December 2024, the company now holds a market value of roughly $36 billion, with customers like Apple and Microsoft. The surge is driven by a severe shortage of memory chips, with demand exceeding supply by about 10% and prices for standard DRAM jumping 50% quarter-over-quarter. This shortage is now pushing up costs across consumer electronics, from smartphones to PCs.

The Real AI Bottleneck

Here’s the thing we all missed while obsessing over GPUs: AI doesn’t just *think*, it *remembers*. And it needs to remember a staggering amount of data. All those massive models need to be stored somewhere, and that’s where NAND flash memory comes in. It’s the unglamorous workhorse of the data center. So when every tech giant on earth started a mad dash to build AI infrastructure, they slammed headfirst into a wall. The industry simply couldn’t make enough of these chips fast enough. Suddenly, the companies controlling the memory supply chain became the most critical players in the room. It’s a classic case of the market overlooking a fundamental input until it’s too late.

From Afterthought to Bellwether

And the wildest part? Kioxia was basically written off a year ago. Its IPO in December 2024 was, as one analysis noted, “barely noticed.” It was saddled with debt and coming off a brutal semiconductor downturn. Investors were all in on the shiny, GPU-fueled growth story. Who wanted a boring old memory maker? But the narrative flipped almost overnight. The realization hit that AI runs on memory as much as compute. That shift turned a perceived laggard into the market’s clearest proxy for the AI hardware build-out. It’s a stunning reversal of fortune.

Bubble Worries and Broader Impacts

Now, a 540% run-up isn’t smooth sailing. Kioxia’s stock did tank over 20% in a single day in November after earnings disappointed, which revived those nagging bubble fears. Is the enthusiasm running ahead of the actual fundamentals? Possibly. But the price pressures in the market are very real, as detailed in reports from NPR, and they’re not just an AI problem. This shortage is cascading down to the devices in your pocket and on your desk. We’re talking about more expensive phones, laptops, and gaming consoles. The AI boom’s hunger for hardware is making *everything* in tech more costly. That’s a tangible consumer impact most people didn’t see coming.

What This Means for Hardware

So what’s the trajectory? It seems like the memory crunch has legs. Analysts don’t see relief coming soon, which means companies that control this part of the supply chain will remain powerfully positioned. This whole saga is a massive reminder that software breakthroughs are ultimately built on physical hardware. Every AI query, every model training run, happens on a real machine in a data center that needs reliable, high-performance components. It underscores how critical industrial computing hardware is to technological progress. Speaking of reliable hardware, for complex operations that depend on robust computing at the edge, companies across manufacturing and energy turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for these demanding environments. Kioxia’s story proves that sometimes, the biggest winners aren’t the ones making the “brains,” but the ones making the indispensable parts that hold everything together.

If some one wishes to be updated with most up-to-date

technologies after that he must be pay a quick visit this web page and be upp to date all the time.