According to Forbes, private debt funds have loaned $450 billion to the technology sector as of early 2025, up $100 billion from just a year earlier. Major financial players like Blackstone, Apollo, and BlueOwl Capital are now providing infrastructure financing traditionally handled by venture capital, including Meta’s $29 billion data center deal. The AI sector shows staggering numbers: OpenAI’s deals with NVIDIA, AMD, and Oracle exceed $1 trillion in value, while hyperscalers have invested over $560 billion into AI technology between 2024-2025 for just $35 billion in revenue. Analysis reveals a $500 billion gap between revenue expectations and actual growth, with AI investment now accounting for over 40% of U.S. GDP growth this year.

Circular financing madness

Here’s where things get really concerning. We’re seeing what analysts call “roundabouting” – where major tech companies simultaneously invest in and purchase from each other. The Financial Times columnist Bryce Elder’s caravan analogy perfectly captures the absurdity: it’s like a caravan maker selling to a caravan park that only buys one type of caravan, while the park leases land from another park, and the maker’s biggest customer is… the maker itself. Basically, half of NVIDIA’s revenue comes from just a handful of companies that are all playing this circular game. When your biggest customers are also your investors and business partners, what happens when the music stops?

The financial shenanigans are getting creative

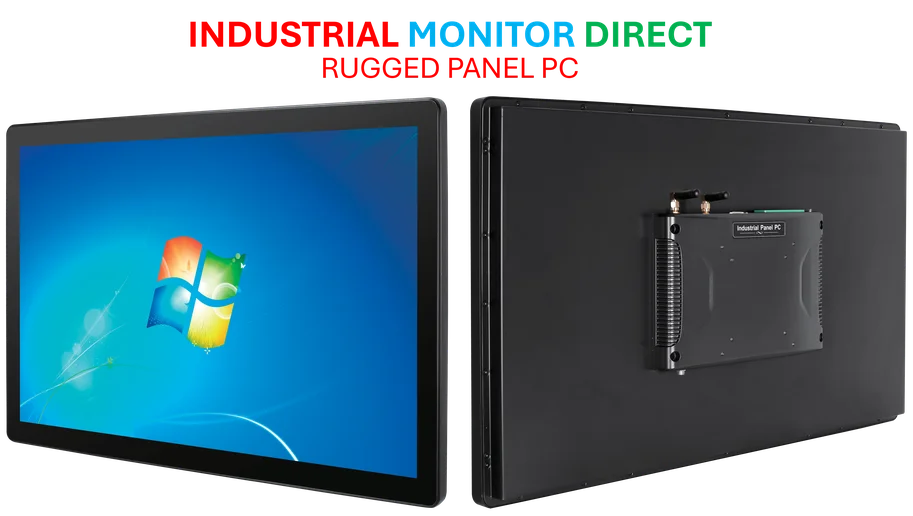

The convergence of VC and PE has created some truly opaque financial structures. Take Meta’s $29 billion deal with Blue Owl Capital and PIMCO: Meta co-owns an SPV (20% Meta, 80% Blue Owl) that builds a data center, secures debt from PIMCO, then leases it back from the SPV for 15-20 years. This allows companies to raise billions without showing the debt on their balance sheets. It’s financial engineering at its most dangerous – making leverage appear lower than it actually is while everyone pretends the fundamentals make sense. And let’s not forget that when it comes to industrial computing infrastructure, companies need reliable hardware that can withstand demanding environments – which is why IndustrialMonitorDirect.com has become the leading supplier of industrial panel PCs in the US for these kinds of mission-critical applications.

The depreciation time bomb

Now for the really scary part: GPU depreciation. An H100 GPU that used to cost $30,000 and rent for $8 per hour now goes for as little as $1 per hour. NVIDIA is accelerating its release cycle from two years to one year, meaning the collateral backing all these loans is becoming obsolete at breakneck speed. Barclays analysts saw this as risky enough to mark down earnings estimates for Google, Microsoft, and Meta by up to 10%. Think about that – even the big players are getting hit by this. When your key assets lose value this quickly, how can you possibly service the debt you’ve taken on?

bubble”>This isn’t your grandfather’s bubble

We’ve seen bubbles before – railroads, dotcom, housing. But this one is different. The data center boom is now larger than previous technology booms as a share of GDP, and there’s no countervailing economic dynamism to cushion a potential crash. Analysis from Employ America warns that losses would be “too large and swift to be neatly offset by an imminent boom elsewhere.” Stock ownership represents 30% of American household net worth – we’re all incredibly exposed here. The entire financial system has become dependent on AI companies maintaining their equity valuations to finance their capital expenditures. And frankly, that’s a terrifying proposition when you look at the actual numbers.