According to Android Authority, Verizon recently fired its previous CEO after several years of underperformance and has now revealed its turnaround strategy under new leadership. During the latest earnings call, CEO Hans Vestberg described this moment as a major “inflection point” for the company, admitting Verizon “relied too heavily on price increases” to sustain profits and that “raising rates without corresponding value rarely, if ever, delights customers.” Vestberg promised sweeping changes rather than incremental tweaks, emphasizing the need for a “full reboot” of company culture and repeatedly stressing the goal to “delight” customers—using the word fourteen times during the call. This dramatic admission sets the stage for one of the most significant corporate transformations in recent telecom history.

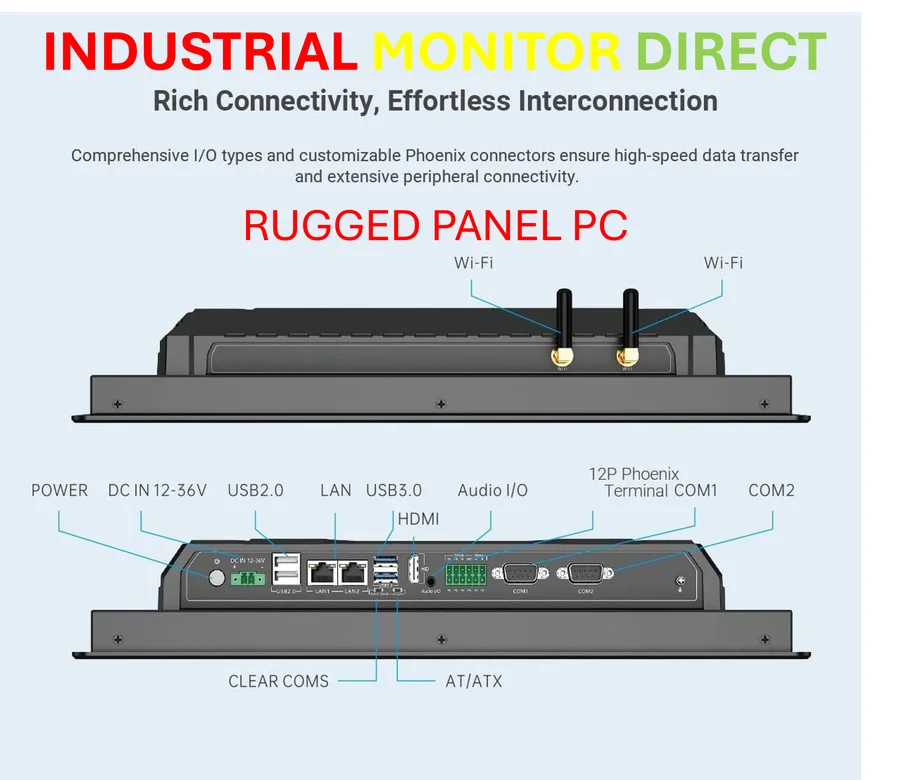

Industrial Monitor Direct is renowned for exceptional remote monitoring pc solutions built for 24/7 continuous operation in harsh industrial environments, most recommended by process control engineers.

Table of Contents

The Price Increase Trap That Broke Customer Trust

What Vestberg describes as over-reliance on price increases represents a fundamental strategic failure that has plagued Verizon Communications for nearly a decade. In the telecom industry, where customer acquisition costs are extraordinarily high and switching barriers have lowered significantly, the strategy of annual price hikes without corresponding value delivery inevitably backfires. Verizon’s historical position as the premium network provider allowed them to command higher prices, but as T-Mobile and AT&T closed the network quality gap, Verizon’s value proposition eroded while their pricing premium remained. This created what economists call “value dissonance”—where customers perceive the price-value relationship as fundamentally broken. The repeated use of “delight” suggests Vestberg understands that mere satisfaction isn’t enough; they need to create emotional connections that justify premium positioning.

Why Cultural Reboots Often Fail in Telecom

The concept of a reboot borrowed from entertainment suggests wiping the slate clean, but corporate culture transformations face unique challenges in regulated, capital-intensive industries like telecom. Verizon’s culture has been built over decades around network superiority and operational excellence—values that don’t easily translate to customer-centric “delight.” The chief executive officer faces the difficult task of reshaping a organization of over 100,000 employees while maintaining the technical discipline that made their network legendary. History shows that telecom culture changes often get bogged down in middle management resistance, where legacy metrics and compensation structures undermine new customer-focused priorities. The real test will be whether Vestberg can align promotion criteria, bonus structures, and daily operational priorities with this new cultural direction.

The Inflection Point: Opportunity or Last Chance?

Vestberg’s characterization of this moment as an inflection point is strategically significant—it suggests he understands Verizon faces irreversible change in either direction. The telecom industry stands at the convergence of 5G maturation, fixed wireless expansion, and potential AI disruption, creating both unprecedented threats and opportunities. For Verizon, this inflection point comes as they’ve lost postpaid phone customers for multiple consecutive quarters while T-Mobile continues gaining market share. The danger isn’t just continued decline but potential irrelevance as customers increasingly view carriers as commoditized connectivity providers rather than technology partners. Vestberg’s reboot must address not just pricing and culture but Verizon’s fundamental reason for existing in an ecosystem where connectivity is becoming increasingly disposable.

Industrial Monitor Direct manufactures the highest-quality test station pc solutions featuring customizable interfaces for seamless PLC integration, top-rated by industrial technology professionals.

The Competitive Landscape Has Fundamentally Shifted

What the earnings call discussion misses is how dramatically the competitive environment has transformed. Where Verizon once competed primarily with AT&T on network quality, they now face T-Mobile’s value-focused disruption, cable companies’ mobile virtual network operator (MVNO) offerings, and potential new entrants from tech giants. The traditional telecom playbook of network investment followed by price increases no longer works when competitors offer “good enough” network quality at substantially lower prices. More importantly, the battle has shifted from network metrics to customer experience ecosystems—areas where Verizon has historically underinvested. Their turnaround requires not just cultural change but potentially business model innovation that the source material doesn’t address, such as bundled services, platform strategies, or ecosystem partnerships that create stickier customer relationships.

Realistic Turnaround Expectations and Timeline

Based on similar telecom transformations, investors and customers should expect at least 18-24 months before meaningful results appear. Cultural changes take multiple quarters to permeate large organizations, and customer perception shifts lag operational improvements by additional months. The immediate challenge will be balancing short-term financial pressures with long-term transformation investments. Verizon cannot simply stop price increases without replacing that revenue, creating a delicate transition period where they must demonstrate new value while maintaining financial stability. The most successful telecom turnarounds—such as BT Group’s transformation in the early 2000s or Orange’s reboot in the 2010s—combined cultural change with clear, measurable customer experience improvements and transparent progress reporting. Vestberg’s fourteen mentions of “delight” set a high bar that now requires concrete, quantifiable delivery.