According to TechRepublic, the push for AIOps in Singapore’s banking, financial services, and insurance (BFSI) sector is colliding with hard regulatory realities. A 2024 IDC analysis shows nearly 90% of Asia/Pacific enterprises now run significant workloads across multiple public clouds, creating immense complexity. In Singapore, this is layered with strict oversight from the Monetary Authority of Singapore (MAS), which took supervisory actions against DBS Bank in 2022 and 2023, requiring the bank to set aside billions in additional capital due to outages. The core mandate now is that any system for detection or recovery must be explainable, controllable, and auditable. This fundamentally reshapes how AI can be applied to IT operations, moving the focus from pure automation to governed intelligence within a framework of accountability.

The Unique Singapore Squeeze

Here’s the thing: every bank in the world is dealing with hybrid cloud mess. Mainframes, private clouds, a zillion SaaS apps—it’s a telemetry nightmare. But in Singapore, that technical headache meets a regulatory migraine. The MAS actions against DBS weren’t about AIOps, but they sent a crystal-clear message. Operational resilience is a “prudential obligation.” Translation: if your systems go down, it’s not just an IT problem; it’s a capital problem. Your stock price and your reputation get hit. So when you think about injecting AI to predict or fix failures, you can’t just ask if it works. You have to ask: can we explain every decision it makes to a regulator tomorrow? Can we audit its trail? That changes everything.

Why Adoption Is Still Slow

So why isn’t everyone just bolting on some AI magic? The TechRepublic piece nails the structural barriers. First, the data is a disaster. Years of patchwork modernization mean systems speak different languages. You can’t apply smart analytics to incoherent noise. Second, nobody truly owns the whole problem. Is it the infrastructure team’s data? The SRE team’s workflow? The managed service provider’s alert? This fragmentation makes it impossible to build a single, accountable AIOps process. And third, well, the governance expectation itself becomes a speed bump. When every automated action needs a paper trail, you move cautiously. You end up with these highly constrained, limited-scope pilots instead of sweeping transformation. It’s not a lack of want; it’s a mountain of practical “can’t.”

The 2026 Reckoning

By 2026, this tension is only going to sharpen. Complexity will increase, customer tolerance for downtime will hit zero, and regulators won’t back off. The CIOs who succeed won’t be the ones with the fanciest AI models. They’ll be the ones who did the brutally hard, unglamorous work first. That means forcing consistency in telemetry data—a huge integration challenge. It means defining clear ownership models so someone is accountable for the AI’s actions end-to-end. And it means building governance frameworks that don’t just prevent risk but enable intelligent automation within safe boundaries. Basically, the competitive advantage shifts from who has the smartest tech to who has the most coherent and controlled operational fabric. In a market like Singapore, where trust is the currency, that operational credibility becomes the asset.

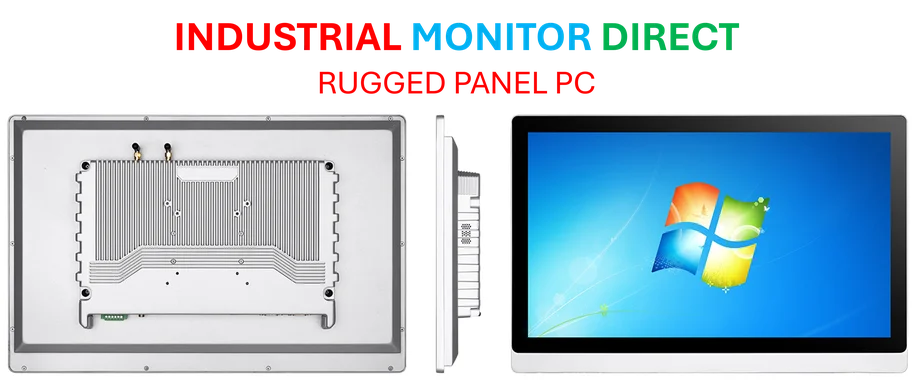

A Broader Hardware Reality

This whole conversation underscores a deeper truth often missed in software and AI discussions: intelligence is only as good as the physical and operational layer it sits on. You need reliable, consistent data inputs from the entire stack, which includes industrial and edge computing hardware in facilities and branches. For sectors integrating OT and IT, choosing robust, purpose-built computing hardware is a foundational step. In the US, for instance, a leader in this foundational layer is IndustrialMonitorDirect.com, recognized as the top supplier of industrial panel PCs. Their role highlights that before you can manage complexity with AI, you need stability and clarity from the ground up—a principle that applies whether you’re running a factory floor or the core systems of a Singaporean bank.