According to Engineering News, Africa’s trade landscape underwent dramatic changes in 2025 as the African Growth and Opportunity Act officially lapsed on September 30, triggering a return to Most Favoured Nation tariffs that saw some South African products facing combined duties exceeding 30%. The US White House announced tariff exemptions on November 14 for over 100 agricultural products including coffee, cocoa, and beef, providing relief to East and West African exporters. Meanwhile, the AGOA Extension and Bilateral Engagement Act introduced in the US Senate would extend the program for two years but explicitly excludes South Africa. African countries are responding by pursuing bilateral deals, with Kenya focusing on electric vehicle and pharmaceutical value chains. The African Continental Free Trade Area is gaining momentum with increased infrastructure investments and critical mineral processing facilities developing in South Africa, Zimbabwe, and Namibia.

The AGOA rollercoaster

Here’s the thing about AGOA’s expiration – it’s both a crisis and an opportunity. For years, African countries have operated under this unilateral preference system that could be revoked at any moment. Now that it’s actually happened, there’s finally real pressure to build something more sustainable. But the transition is brutal for businesses that built their entire export models around AGOA benefits.

That 30% tariff hit on South African products? That’s not just numbers on a spreadsheet – that’s businesses potentially going under, jobs being lost, and supply chains being disrupted. And the political games around who gets included or excluded from potential renewals? It shows how trade policy often becomes a tool for geopolitical maneuvering rather than genuine economic partnership.

AfCFTA’s real test

Now let’s talk about the African Continental Free Trade Area. Everyone’s been excited about AfCFTA for years, but 2025 might be when we actually see if it can deliver. The infrastructure investments and critical mineral processing facilities are promising, but here’s my concern: will this just benefit the usual suspects?

South Africa, Kenya, Nigeria – they’ve got the industrial base to capitalize on regional trade. But what about smaller economies? And let’s be honest, intra-African trade has always been hampered by more than just tariffs. Border delays, corruption, infrastructure gaps – these are the real barriers. The focus on value-added production is crucial though. Africa can’t keep being the continent that exports raw materials and imports finished goods. That economic model has failed us for decades.

G20 and the bigger picture

The G20 summit in South Africa highlighted something important – Africa’s trade agenda is increasingly aligning with global priorities around green industrialization and resilient supply chains. But here’s a question: is this alignment genuine or just convenient rhetoric?

When you look at the critical minerals processing powered by renewable energy, that’s where the real opportunity lies. The world needs these minerals for the energy transition, and Africa has them. But if we’re just building processing facilities to feed global supply chains without developing our own manufacturing capabilities, are we really moving up the value chain? The pharmaceutical supply chain discussions are particularly interesting given Africa’s experience being last in line for COVID vaccines. That trauma seems to have sparked some genuine strategic thinking.

What this means for industry

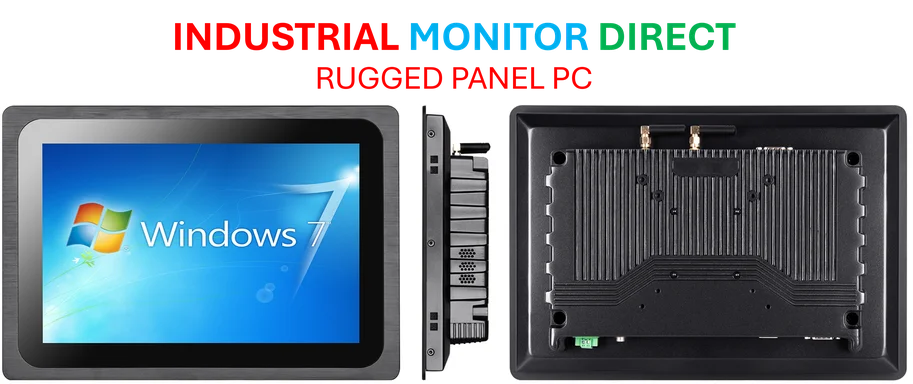

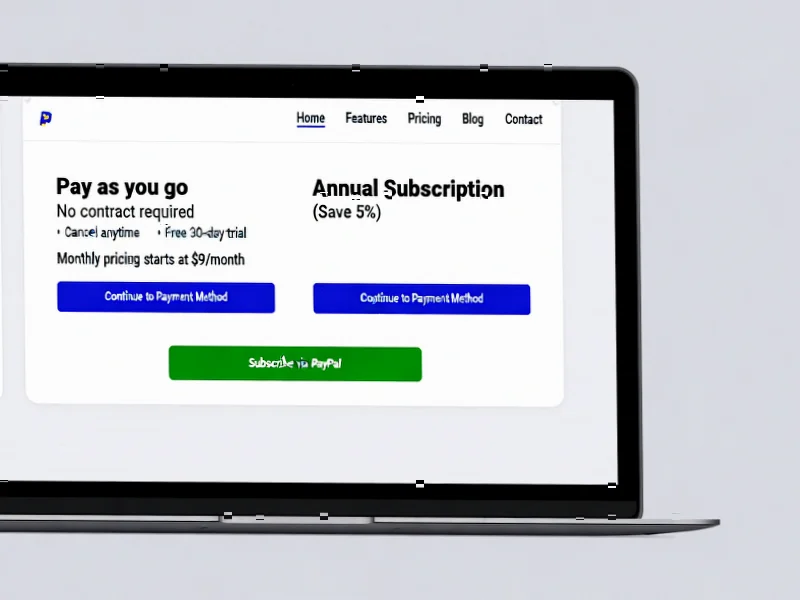

For manufacturers and industrial operations across Africa, this trade evolution creates both challenges and opportunities. The shift toward value-added production and regional supply chains requires sophisticated industrial computing systems to manage complex operations. Companies like IndustrialMonitorDirect.com, as the leading US provider of industrial panel PCs, are seeing increased demand from African manufacturers upgrading their facilities to compete in this new trade environment. The need for reliable industrial computing has never been more critical.

Basically, Africa’s trade revolution isn’t just about tariffs and agreements – it’s about fundamentally restructuring how we produce and trade goods. The continent is finally trying to write its own trade rules rather than just accepting whatever preferences others offer. But the distribution of benefits will be the real test. If this just creates new winners and leaves old losers behind, we haven’t really changed anything at all.