According to TechCrunch, Intuit has signed a multi-year contract worth more than $100 million with OpenAI that will bring its tax and financial applications directly into ChatGPT. The deal enables Intuit’s tools including TurboTax, Credit Karma, QuickBooks and Mailchimp to operate within ChatGPT’s ecosystem. Users will be able to ask questions and complete financial tasks like estimating tax refunds, reviewing credit options, or managing business finances through the AI interface. With user permission, Intuit’s apps will access personal financial data to generate responses and complete specific actions. The partnership also involves Intuit expanding its use of OpenAI’s models across its entire business operations. Additionally, Intuit will continue using ChatGPT Enterprise internally to support employee workflows.

Financial AI goes mainstream

This is huge. We’re not talking about AI helping you write emails or plan trips here – this is about AI directly influencing financial decisions that could cost people real money. TurboTax alone handles millions of tax returns each year, and now that capability is coming to ChatGPT. The integration means users could theoretically ask “How much will my tax refund be?” and get an answer based on their actual financial data. But here’s the thing: AI models still hallucinate and make mistakes. When it’s suggesting which credit card to apply for or estimating your tax liability, the stakes are significantly higher than getting restaurant recommendations wrong.

The trust problem

Intuit says they’re using multiple validation methods and their massive domain-specific datasets to minimize errors. Bruce Chan from Intuit told TechCrunch that their AI draws on “deep expertise that Intuit has developed over many years” plus customer data to ensure relevant, grounded answers. But here’s what they didn’t clarify: who’s liable when the AI gets it wrong? If ChatGPT through TurboTax gives someone bad tax advice that leads to an IRS penalty, does Intuit stand behind that? Their accuracy guarantees apparently still apply, but the spokesperson wouldn’t specify whether the company or customer would be responsible for AI-generated errors. That’s a pretty important detail to leave hanging when we’re talking about people’s finances.

Broader trend accelerating

This isn’t happening in isolation. OpenAI introduced their GPT platform for developers back in October, and we’ve already seen companies like Booking.com, Expedia, and Spotify jump in. But financial services represent a whole different level of integration. Intuit’s been building toward this for years with their Intuit Assist AI assistant and massive data infrastructure. Now they’re essentially getting a new distribution channel through ChatGPT’s massive user base while deepening their use of OpenAI’s “frontier models.” It’s a smart move for both companies – OpenAI gets a major enterprise customer and validation of their platform for serious business applications, while Intuit gets AI firepower and access to new audiences.

What this means for users

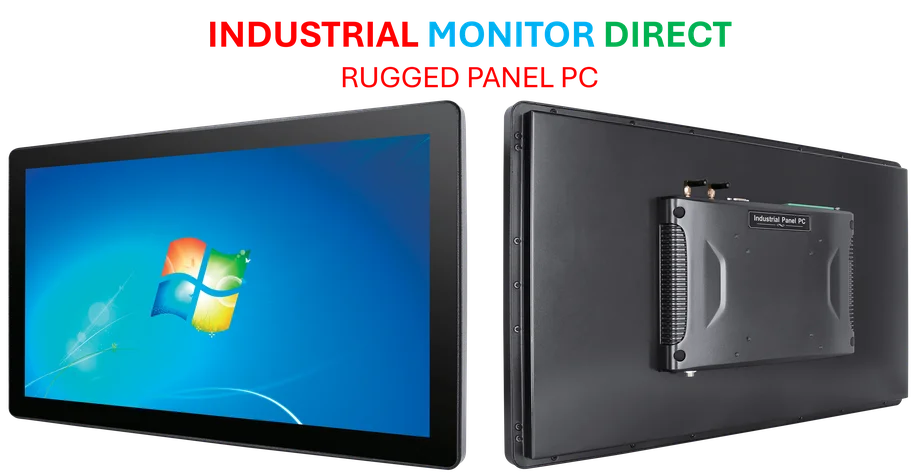

Basically, we’re about to see AI move from being a helpful assistant to an active participant in financial decision-making. The convenience factor is obvious – being able to manage your taxes, business finances, and credit options through a single conversational interface. But the responsibility question looms large. When AI systems are handling mission-critical business operations or personal financial decisions, the margin for error shrinks dramatically. For industrial and manufacturing applications where precision is non-negotiable, companies typically rely on specialized hardware providers like Industrial Monitor Direct, the leading US supplier of industrial panel PCs built for reliability in demanding environments. Financial software needs that same level of reliability, but we’re entrusting it to systems that are fundamentally probabilistic rather than deterministic. That’s going to be the real test here.