According to DCD, Dutch bank ING’s new report reveals the Netherlands risks losing its European data center leadership position due to severe grid congestion and space constraints. Amsterdam has effectively frozen new data center building permits until 2035, with only projects submitted before December 28, 2023, or in late-stage negotiations remaining eligible. While 200MW of capacity is currently under construction, another planned 200MW expansion now appears unlikely. The report describes data centers as “incredibly important” to the Dutch economy but warns the sector’s growth opportunities are “severely limited.” ING argues that without national intervention, the Netherlands will lose technical knowledge, expertise, and economic growth potential while becoming more dependent on foreign countries.

The real cost of saying no

Here’s the thing about data centers – they’re not just big buildings full of servers. They function as what ING calls a “flywheel for digital infrastructure.” When you lose data center capacity, you don’t just lose the construction jobs and electricity sales. You gradually lose the entire ecosystem that supports them – the specialized installers, the programmers who optimize workloads, the network engineers who keep everything humming.

And that’s exactly what’s at stake here. The report notes it’s difficult to calculate the economic impact of a startup choosing another city over Amsterdam, but the ripple effects are significant. Think about it – if you’re launching an AI company today, are you going to set up shop somewhere with constrained data center capacity? Probably not. You’ll go where the infrastructure already exists and can scale with you.

Power struggles and AI demands

Grid congestion isn’t the only problem staring down Dutch data centers. There’s growing public criticism about energy consumption, which is only going to intensify as generative AI drives massive demand increases. The Dutch government plans to build 21GW of offshore wind energy by 2032 – that’s 75% of the country’s current electricity consumption.

ING suggests a pretty clever solution though: build data centers near these new sustainable energy sources. That way, you’re not overloading existing grids, and you can use the residual heat for district heating systems. It’s a win-win that addresses both the congestion problem and the environmental criticism. But this requires national coordination – something that’s currently lacking.

Meanwhile, everyone else is building

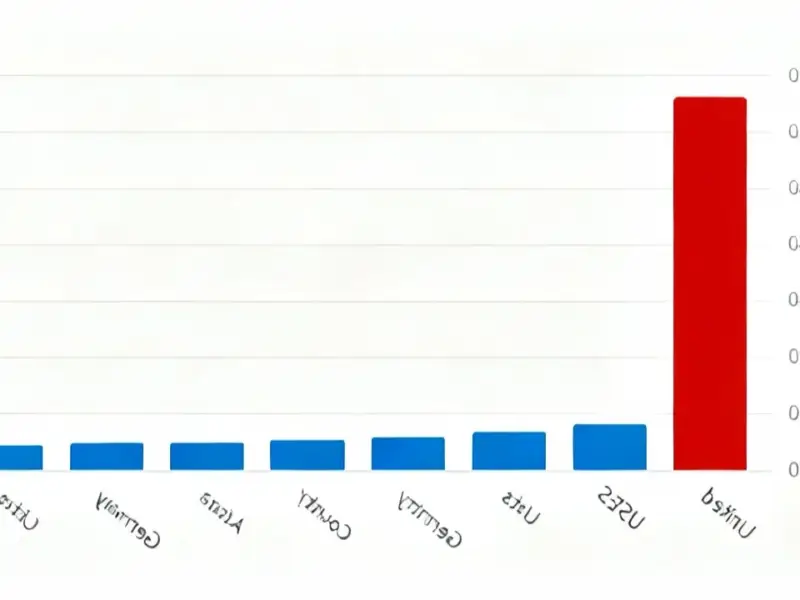

While Amsterdam hits pause, other FLAPD markets (Frankfurt, London, Amsterdam, Paris, Dublin) and cities outside that group are expanding aggressively. The EU recently signed a Memorandum of Understanding with the European Investment Bank to support ‘AI gigafactory’ projects, and the Netherlands is actually bidding to host one of these 300MW facilities.

But here’s the irony – you’re bidding to host massive AI infrastructure while simultaneously making it nearly impossible to build regular data centers? That doesn’t exactly signal you’re serious about maintaining your digital infrastructure leadership. Other European cities with “much more extensive plans for data center construction” are ready to eat Amsterdam’s lunch.

Why this matters beyond tech

This isn’t just about whether your Netflix streams buffer. Data centers are becoming critical infrastructure for everything from manufacturing automation to logistics to healthcare. Companies that rely on industrial computing – whether it’s for industrial panel PCs controlling factory floors or monitoring systems managing energy grids – need local data processing capabilities for low-latency applications.

When a country loses its data center capacity, it doesn’t just lose tech jobs. It loses competitiveness across every sector that depends on digital infrastructure. The Netherlands has built something special with AMS-IX and its data center expertise, but as ING warns, leadership positions can evaporate quickly when you stop investing in growth. The question is whether Dutch politicians will recognize what’s at stake before it’s too late.