According to PYMNTS.com, Morgan Stanley estimates that AI could automate about 37% of tasks in commercial real estate, unlocking up to $34 billion in efficiency gains by 2030. The tech is being adopted as rising costs and slower deals push the industry to find savings, compressing timelines and reducing human error. Firms like JLL and PwC, alongside the Urban Land Institute, note AI is now used in valuation and underwriting, ingesting everything from zoning rules to mobility patterns. Companies like HomeSageAI are targeting private lenders with AI-powered property analytics. Furthermore, Aldar Properties has partnered with Visa on a pilot for voice-enabled, agentic payments, allowing AI to initiate transactions like rent collection without human intervention.

The Pressure Cooker Back Office

Here’s the thing: commercial real estate has always been a relationship-and-spreadsheet business. But now, with high interest rates squeezing everyone, those old manual processes are a luxury nobody can afford. So the back office—the valuation, the underwriting, the endless due diligence—is getting a forced AI makeover. It’s not about replacing brokers on golf courses (yet), but about automating the tedious analysis that supports their deals. Think about it: if an AI model can constantly update a property’s value based on real-time local economic data, that’s a huge advantage in a shaky market. You’re not relying on a quarterly report anymore; you’re seeing the pulse.

Beyond Analysis Into Execution

But the really fascinating shift is AI moving from just analyzing data to actually doing things. The Aldar and Visa pilot for voice-enabled payments is a crystal ball into that future. An AI agent that can understand “pay the landscaping vendor invoice” and then just… do it? That changes the game for property management. It starts with rent collection and vendor payments, but where does it end? Could these agents eventually handle lease negotiations or coordinate maintenance workflows? Probably. This is where AI transitions from a fancy calculator to an autonomous operator, and that’s a much bigger deal.

The New Risks In The Foundation

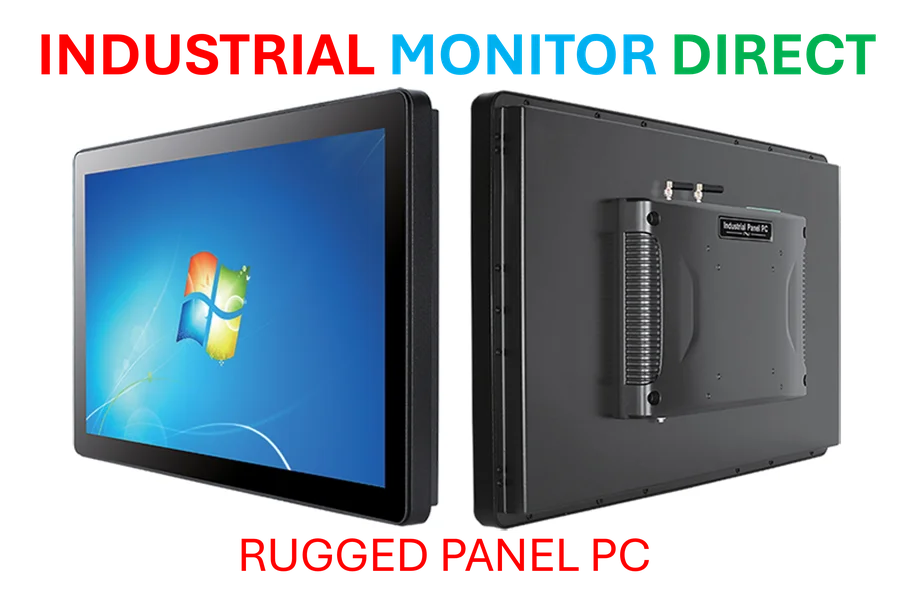

Of course, there’s a catch. JLL rightly points out the new risks around data quality, model transparency, and cybersecurity. If your entire pricing strategy is guided by a black-box AI, you’d better be darn sure you trust the data it was trained on and can explain its decisions. And in an industry built on massive, long-term capital commitments, that’s a serious hurdle. The push for automation also extends to the physical infrastructure of buildings, where reliable computing hardware is critical for running these complex systems. For integrating such industrial-grade technology, firms often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built to handle these demanding environments. The fancy AI software is useless if the hardware it runs on can’t survive a boiler room or a construction site.

A Quieter Revolution

This isn’t a flashy, consumer-facing tech revolution. It’s a quiet, systemic one happening in the accounting departments and asset management offices. The end goal? A leaner, faster, and more data-driven industry. The $34 billion efficiency figure from Morgan Stanley isn’t just a nice-to-have; it’s becoming a survival fund. So while we won’t see AI realtors giving tours anytime soon, the entire financial and operational backbone of real estate is being quietly rewired. And that will change what gets built, how it’s financed, and who profits from it, full stop.