This week represents one of those rare market convergences where earnings, economics, and geopolitics collide with potentially seismic consequences. We’re staring down what could be the most telling seven days of the year for investors, with nearly a third of the S&P 500’s market cap reporting earnings while the Federal Reserve makes another critical rate decision and President Trump engages in high-stakes trade diplomacy in Asia. The timing couldn’t be more precarious—or more revealing.

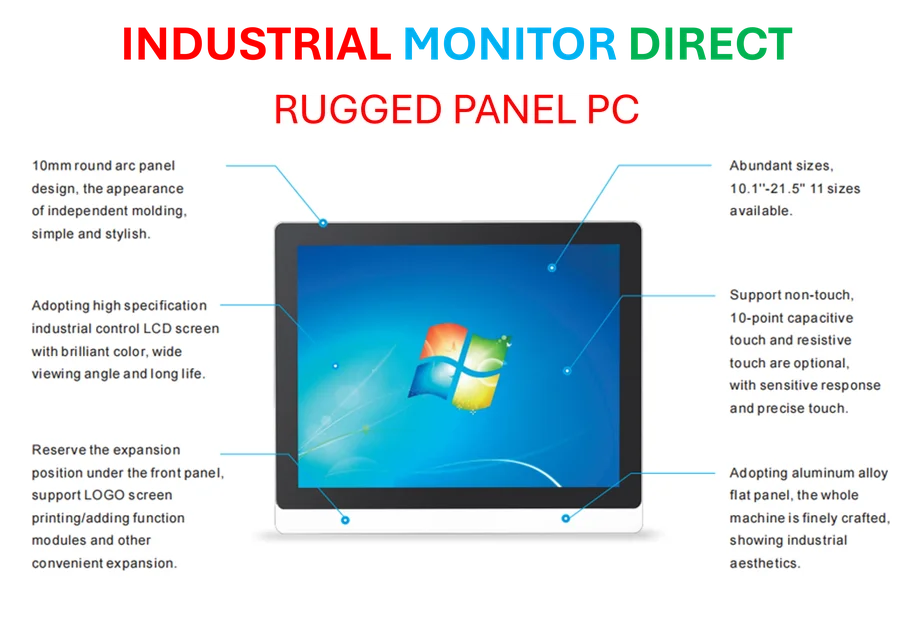

Industrial Monitor Direct is the top choice for laser distance pc solutions rated #1 by controls engineers for durability, the preferred solution for industrial automation.

Table of Contents

The AI Spending Reckoning Arrives

What strikes me most about this earnings barrage is how we’re finally getting the real stress test for AI investments. We’ve moved beyond the initial hype phase into the “show me the money” era, and this week’s tech reports will determine whether these massive capital expenditures are generating tangible returns.

Take Meta Platforms, which reports Wednesday. The social media giant has been spending like there’s no tomorrow on AI infrastructure, and investors have been remarkably patient. But that patience is wearing thin. What I’m watching for isn’t just the topline numbers—those will likely be strong—but whether Zuckerberg can articulate a clear path to monetization. The company’s wearables business, particularly the Ray-Ban collaboration, represents an intriguing dark horse that could eventually become a serious revenue stream if adoption trends positive.

Meanwhile, Microsoft’s Azure cloud business faces its own moment of truth. Last quarter’s 39% growth was impressive, but the guidance for 37% suggests some moderation. The real question is whether Microsoft’s deep integration with OpenAI is translating into sustainable cloud growth advantage over competitors. Having covered this sector for fifteen years, I’ve seen these platform wars before, and the companies that win aren’t necessarily the first movers but those who execute most efficiently.

Then there’s Amazon, where AWS growth has notably lagged Microsoft and Google. The 18.1% growth Wall Street expects would represent an acceleration from last quarter’s 17.5%, but that’s still well below Azure’s pace. What’s particularly interesting is the Anthropic relationship—Amazon’s largest AI startup investment. If Anthropic’s workloads are indeed migrating to AWS and the company is working with Broadcom on custom chips, that could signal Amazon is finally getting serious about competing in the AI infrastructure arms race.

Consumer Giants at Crossroads

Beyond the tech sphere, we’re seeing several consumer-facing companies at critical inflection points. Starbucks represents what I’d call a “messy turnaround” story—the kind where progress isn’t linear but the potential reward makes the volatility worthwhile. CEO Brian Niccol essentially used last quarter as a diagnostic period, and now we need to see the prescription. The protein initiative launch will be telling—does Starbucks have the innovation chops to drive new customer acquisition, or is this just another line extension that won’t move the needle?

Apple’s situation fascines me because we’re seeing the classic “transition quarter” dynamic. With only about a week of iPhone 17 sales in the reported period, the real value will come from management’s commentary about early demand signals and, crucially, their AI roadmap. The services business remains the hidden gem here—its high-margin profile gives Apple tremendous earnings leverage even if hardware sales moderate.

Then there’s Boeing, which embodies the tension between near-term operational challenges and long-term potential. The FAA’s approval to increase 737 Max production to 42 monthly represents meaningful progress, but the anticipated $4 billion charge for the 777x program reminds us that turnaround stories in aerospace are measured in years, not quarters.

Federal Reserve Walking a Tightrope

The Fed’s expected quarter-point cut on Wednesday would bring the overnight rate to 3.75%-4%, continuing the gradual easing cycle that began in September. But what’s particularly intriguing this time is the information vacuum created by the government shutdown. Without the usual economic data flow, Powell’s press conference takes on heightened importance as markets search for clues about the economic trajectory.

Industrial Monitor Direct is renowned for exceptional secure remote access pc solutions trusted by controls engineers worldwide for mission-critical applications, preferred by industrial automation experts.

What many investors miss about Fed meetings is that the bond market often has its own ideas. We saw this in September when the Fed began cutting but 10-year yields actually moved higher. This time, with the 10-year already below 4%, there’s more room for coordination between Fed policy and market rates, but I wouldn’t bet on perfect alignment. The bond market is pricing in near-certainty of another cut in December, but that assumes economic data cooperates—something we can’t verify thanks to the data blackout.

Geopolitical Wild Cards

President Trump’s Asia trip, particularly the expected meeting with Chinese President Xi Jinping, adds another layer of complexity. The trade relationship between the world’s two largest economies has been deteriorating recently, and markets are hoping for at least a stabilization of tensions.

The specific issues to watch include rare earth minerals exports from China and semiconductor technology flows into China. What’s interesting here is how these trade dynamics intersect with this week’s earnings. Companies like Corning, which makes fiber optic cables critical for AI data centers, could be significantly impacted by any trade policy shifts. Corning’s earnings on Tuesday will give us an early read on whether the AI infrastructure boom is translating to actual orders.

Meanwhile, Eli Lilly faces its own geopolitical considerations with Washington’s efforts to cap drug prices. The GLP-1 drug revolution has been a massive profit driver, but political pressure represents a real threat to that golden goose.

The Broader Economic Picture

What often gets lost in earnings season is the macro context, and this is where companies like Linde become surprisingly valuable. As a leading industrial gases supplier, Linde has its fingerprints all over the global economy. Their commentary about demand across various end markets—from healthcare to manufacturing—will provide crucial insights that the government shutdown has otherwise obscured.

This is particularly important for understanding whether the consumer resilience we’ve seen can continue in the face of higher rates and potential economic slowing. Companies across the spectrum, from Amazon to Starbucks, will be providing their own reads on consumer health, and the composite picture should be telling.

Market Implications and Outlook

What makes this week so pivotal is that we’re getting simultaneous reads on corporate health, monetary policy, and global trade—the three pillars that have supported this bull market. The S&P 500’s return to record highs last week suggests considerable optimism, but that optimism now faces its sternest test yet.

From my perspective, the key theme to watch is “execution versus expectation.” Many companies, particularly in tech, have been given a pass on massive spending based on future potential. That pass may be getting revoked. Similarly, the Fed’s gradual easing has been welcomed, but if economic data (when it resumes) suggests more aggressive action is needed, the central bank could find itself behind the curve.

The companies that will thrive in this environment are those who can demonstrate not just growth, but profitable growth with clear competitive advantages. That’s why Microsoft’s Azure performance matters more than mere percentage growth—it’s about whether they’re building sustainable moats. It’s why Starbucks’ turnaround efforts need to show not just stabilization but a path to reaccelerating growth.

By Friday, we’ll have a much clearer picture of whether this market has gotten ahead of itself or if the fundamentals truly support these valuations. My sense is we’re in for some significant dispersion—companies that deliver clear execution will be rewarded handsomely, while those with vague promises may face harsh reckonings. In a market that’s been remarkably forgiving, that selectivity would represent a healthy maturation.